If this happens, XRP will print out new all-time highs: Analyst

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

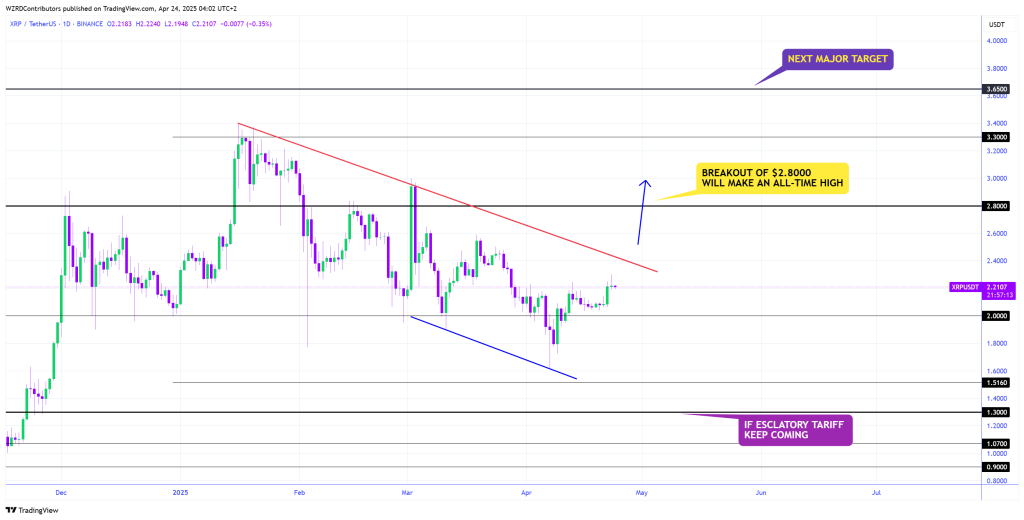

The new daily chart shared by market technician @Cryptowzrd_ shows that XRP is just a technical trigger, away from price discovery. The analyst’s chart (posted on TradingView earlier Thursday) plotted XRP/USDT on Binance and showed token turnover at $2.2107 after Wednesday’s daily indecisive daily shutdown.

XRP Target $3.65

The most eye-catching feature is the trend line (drawn in red) extending from the February 3 swing to the latest lower cluster. The line currently has a slightly higher price than the market and has been limiting every relief rally since mid-January. According to WZRD, candles that break through this “low trend line” every day will ignite “very fast impulsive action” to the next horizontal barrier, at a price of $2.80.

Why the $2.80 is elucidated with a bright yellow call on the chart: In wzrd’s words, close distances above that level will most likely “make historically high.” Charts above $2.80 have little historical structure until $3.30 (marking the highest weekly price for January).

Related Readings

Next, the analyst targeted the $3.65 area, labeled as the purple “next major target.” The band is the highest black level drawing, representing analysts’ first goal in the field of price discovery.

Support is also clearly defined. The $2.00 thick black horizontal level is marked “Main Daily Support Target”. Below this, continuous shelves are marked $1.5160, $1.3000, $1.0700 and $0.9000, with annotated $1.30, warning that the break may appear “if the escalation tariff continues to be lowered.” The secondary blue trend line connects to late March and early April lows, creating a short-term fallen leaf-like structure whose upside resolution has begun to relax some bearish momentum.

The comments accompanying WZRD highlight the interaction between Spot XRP and performance against Bitcoin. He noted that XRP/BTC is coiling a symmetrical triangle that will “mature” in the higher movement of Bitcoin’s advantage. Positive moves will add an end to the dollar pair.

“XRPBTC needs the help of Bitcoin’s advantage. Rising from its current position will help the market move the next impulse towards its upper high trend line, where it will maturate the symmetrical triangle and eventually improve. The regular price action of XRPBTC will help XRP become more cowboy from its current position,” WZRD added. ”

Instead, the “off-and-off” bitcoin can bottle XRP between $2.2050 and $2.00, a series that defines intraday trading on Tuesday. “Although I hope that the overall sentiment of Bitcoin will also have an impact on XRP, although I would like to see positive action from XRPBTC. My focus will be kept on lower timeframe chart development to get the next healthy trade setting,” the analyst wrote.

The focus is on the development of a lower time frame: Any decisive daily solution above the red trend line will confirm a trend reversal and lay the foundation for a sprint to $2.80, and analysts believe that this level will fall, and analysts believe history will be in manufacturing.

At press time, XRP was trading at $2.13.

Featured Images created with dall.e, Charts for TradingView.com