Is $100,000 the next goal or the trap in the gold bag?

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

Bitcoin Bull is Try to push up Starting from less than $97,000, trying to confirm that its latest breakthrough exceeds the multi-day consolidation range. After stagnating nearly $95,000 in more than a week, Bitcoin broke out to $97,000, then reversed and formed a fair value gap.

Related Readings

This has led to a surge in activity in Bitcoin blockchain activity, and the next prospect is The structure can continue to $100,000, or if that momentum can stagger in the resistance zone.

Bitcoin reaches its peak of 6 months in network activity

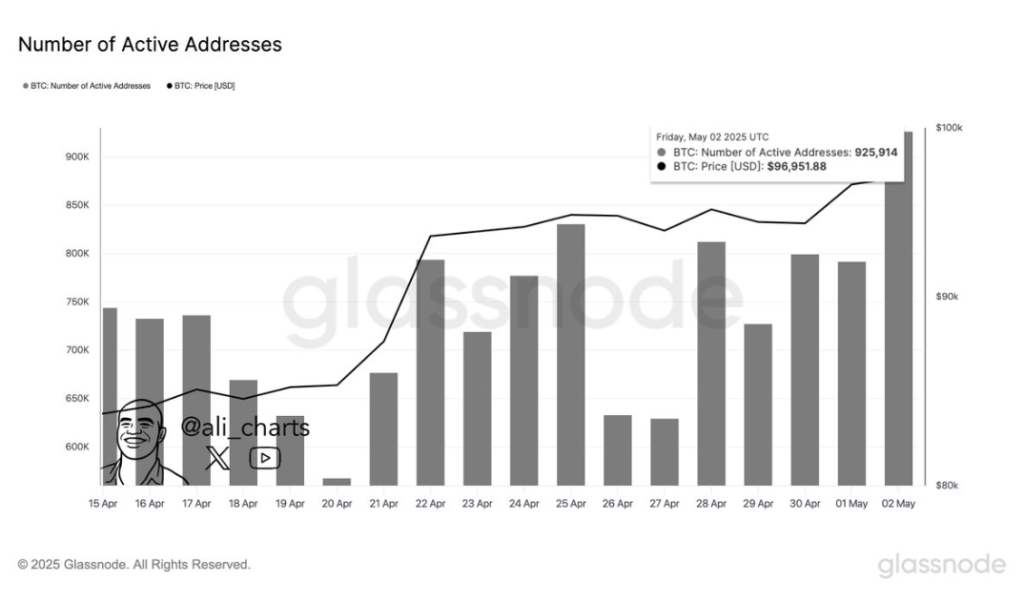

One of the most eye-catching changes in market dynamics comes from the chain side. According to crypto analyst Ali Martinez The highest number was just recorded Active address in the past six months. As shared in the post on social media platform X, Martinez noted that there are 925,914 BTC addresses that are active in a day, which is a Extremely high participation On the Bitcoin blockchain.

The accompanying glass festival chart reveals the steepness of this surge, based on a gradual climb that began the last week of April. Interestingly, the surge in Bitcoin activity coincides with the recent recovery of the $95,000 price range.

Image of x: @ali_charts

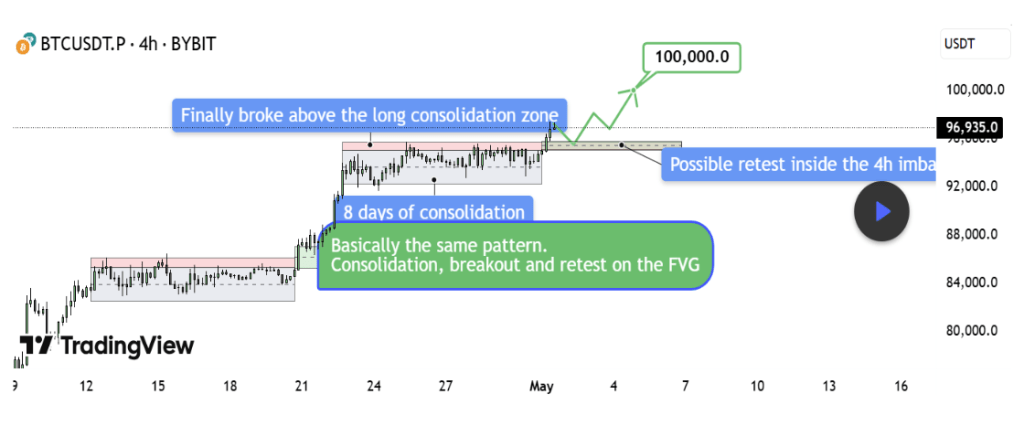

Crypto analyst Tehthomas joins bullish case Shared a compelling Technical analysis that points out breakthroughs Continued to $100,000. The explanation of the BTCUSDT 4-hour time frame shows almost the same structure as seen in mid-April.

At that time, Bitcoin merged about $86,000, broke out, leaving behind the fair value gap (FVG), retested the gap, and gathered nearly $10,000. Mirroring of this mode It is currently underway. Bitcoin price compressed below $95,000, breaking the resistance and creating fresh FVGs of $94,200 to $95,000.

Tehthomas points out that the key is not about chasing breakthroughs, but about waiting for the new FVG to be cleaned and retested. If buyers defended the area like earlier this month, the road to $100,000 is structurally complete. But even if the current structure favors the Bulls, the situation could turn into bearish if Bitcoin drops to the old product range below $94,000.

Chart from TradingView

Bearish gold bag setting highlights future risks

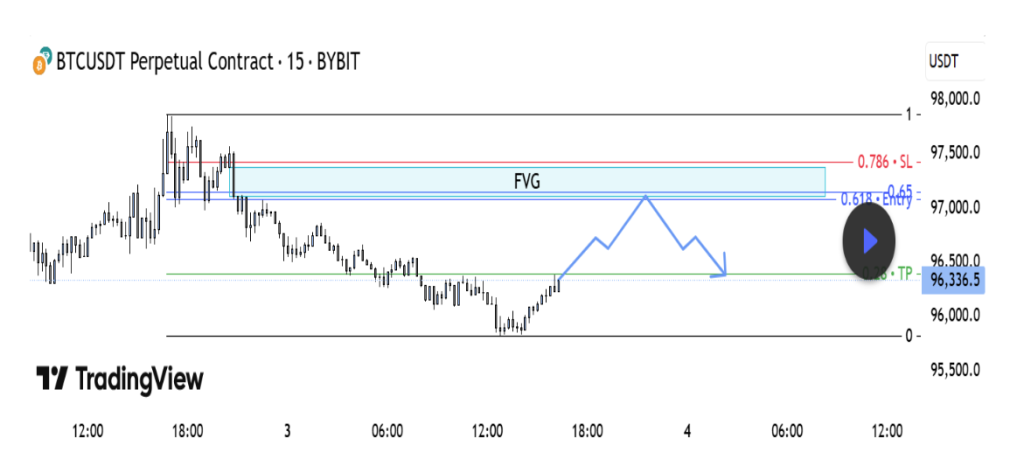

Not all analysts believe it The Bitcoin will again hit $100,000 without shaking it first. Reverse view The TradingView platform highlights a possible short-term bearish setting based on the BTCUSDT 15-minute chart.

According to analysts, the current upward retreatment seems to be corrective, rather than impulsive, forming a classic short setup within the strong fair value gap resistance area. Technical analysis shows that Bitcoin has fallen back to an area consistent with the bearish fair value gap and the golden pocket area defined by the 0.618 to 0.65 Fibonacci level.

Related Readings

For now, the fair value gap is between $97,000 and $97,450. If the price fails to break through this supply zone, it may reverse And caught the bull off guard.

Chart from TradingView

At the time of writing, Bitcoin trades at $96,040.

Featured images from Unsplash, charts for TradingView