Bitcoin on the Edge of Extreme Greedy – Is euphoria coming?

The data show that Bitcoin traders’ sentiment has been shaking on the brink of extreme greed over the past few days, suggesting a break may occur.

Bitcoin Fear and Greed Index Sitting on the Boundary of Extreme Greed

The “Fear and Greed Index” refers to the metric created by alternatives, introducing us to the average sentiment present among investors in Bitcoin and the broader cryptocurrency market.

This index uses a numerical scale from zero to one hundred to represent market sentiment. All values above 53 correspond to greed among investors, while those below 47 indicate fear. The internal level naturally corresponds to the neutral mentality of the network.

Now, according to the Fear and Greed Index, this is what the current market sentiment looks like:

The value of the metric appears to be 74 at the moment | Source: Alternative

As mentioned above, the indicator is currently worth 74, meaning investors generally share greed and strong emotions, considering high value.

In fact, this value is so high that it is on the portal to a special area called “Extremely Greedy”. The region is above level 75, corresponding to euphoria among Bitcoin traders. There are similar areas on the other end of the scale, called Extreme Fear (under 25). When the index is in the region, it naturally indicates that investors are in the deepest state of despair.

Historically, both regions have a lot of significance to Bitcoin and other digital assets, as a major reversal occurred when investors have these mentalities. Therefore, extreme greed leads to the top and extreme fear at the bottom.

Recently, Bitcoin has climbed to its high price levels ever since, so it is no surprise that sentiment is heating up. Nevertheless, at the moment, the index has not yet been broken down into extreme greedy areas, so running may have more space before overflow can become a problem.

But, given that the index of fear and greed has been sitting on this boundary for three consecutive days, it’s only yet to be seen how long it will last.

The trend in the Fear & Greed Index over the past twelve months | Source: Alternative

Any continuation to the rally can push market sentiment beyond the threshold of extreme greed, when a reversal may become more likely, with the higher the index investment.

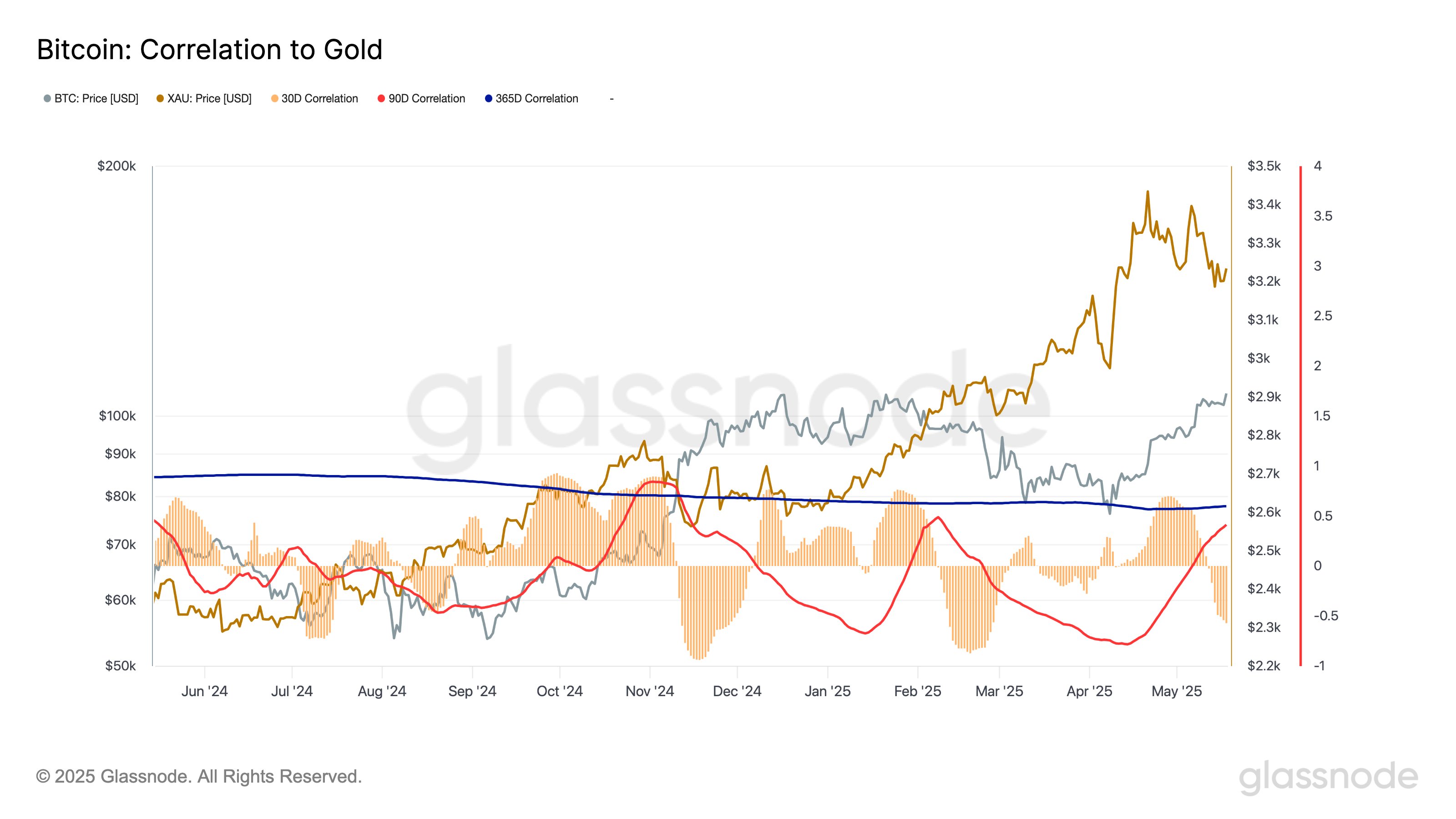

In some other news, Bitcoin’s 30-day correlation with gold has recently dropped to its lowest level since February, as analytics firm GlassNode points out in X’s post.

Looks like BTC's correlation to Gold is negative on the monthly timeframe | Source: Glassnode on X

Currently, the value of the 30-day correlation between Bitcoin and gold is -0.54, meaning that over the past month, the two have been somewhat opposite to each other.

BTC price

Bitcoin saw a sharp hit to the $107,000 level yesterday, but the coin has since dropped rapidly since as it now sells for around $102,300.

The price of the coin has been moving sideways in the last few days | Source: BTCUSDT on TradingView

Dall-E, GlassNode.com, Featured Images of Alternatives, Charts of TradingView.com

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.