Musk-Trump of cryptocurrency is shaky, suffering from a $1 billion washout

Data shows that the cryptocurrency sector has seen a lot of liquidation after the volatility that Bitcoin and others have experienced over the past few days.

Bitcoin has seen roller coasters on roller coasters in the past 24 hours

The whole price of Bitcoin and cryptocurrency markets has shown some significant volatility over the past day, and it was a crazy time. BTC, in particular, has experienced roller coasters, and its prices see fluctuations in both up and down directions.

Here is a chart showing how recent price action looks for the number one digital asset.

As shown, the price of Bitcoin first dropped from a high price of about $105,800 to a low of $100,400, and then witnessed the recovery volume to $104,100.

The coins have been generally declining over the past day, but their losses are less than 2%. Other cryptocurrencies aren’t that lucky because their prices haven’t been fully reviewed yet. Ethereum is still down almost 6%, about 7%.

The industry’s storm followed a public dispute between U.S. President Donald Trump and Tesla founder Elon Musk. Spit started when the former said at an Oval Office meeting that he was “disappointed” by his criticism of the A Large Bill. Musk previously called the bill “annoying abhorrent.”

The two made Sparks fly around on social media, and the SpaceX founder even accused the president of being in the Epstein archives. “This is the real reason they haven’t made public,” Musk said in his post X.

Encryption clearing is close to $1 billion

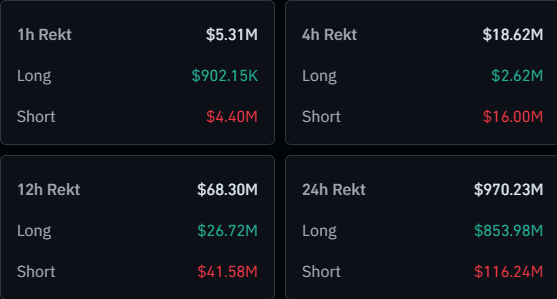

All volatility has captured bitcoin and companies over the past day, and it can only be expected that the derivatives market will feel the impact. According to Coinglass data, a large amount of clearing is piled up on various centralized exchanges.

“Liquidation” here naturally refers to any open contract, that is, if a certain percentage of losses accumulates, it must go through any open contract.

As shown in the table, the cryptocurrency market has cleared up to $970 million in the past 24 hours. Of these, a staggering $854 million was provided by long-term investors, accounting for 88% of the total. It is natural that in this window, the overall price has fallen.

As usual, both Bitcoin and Ethereum lead the clearing industry in the industry, contributing $346 million and $286 million, respectively.

Large-scale liquidation events are often called “squeezing”. Considering that desire has made up for the vast majority of the latest activity, it can be called a long-term squeeze.