Nearly 60% of profit holders are now

Data on the chain shows that Ethereum investors’ profitability has dropped sharply after the latest asset prices rally.

Ethereum holders’ profitability has recently observed a dramatic reversal

In a new post on X, the Institutional Defi solution provides Sentora (formerly Intotheblock) with a look at how the profit loss situation on the Ethereum network has changed.

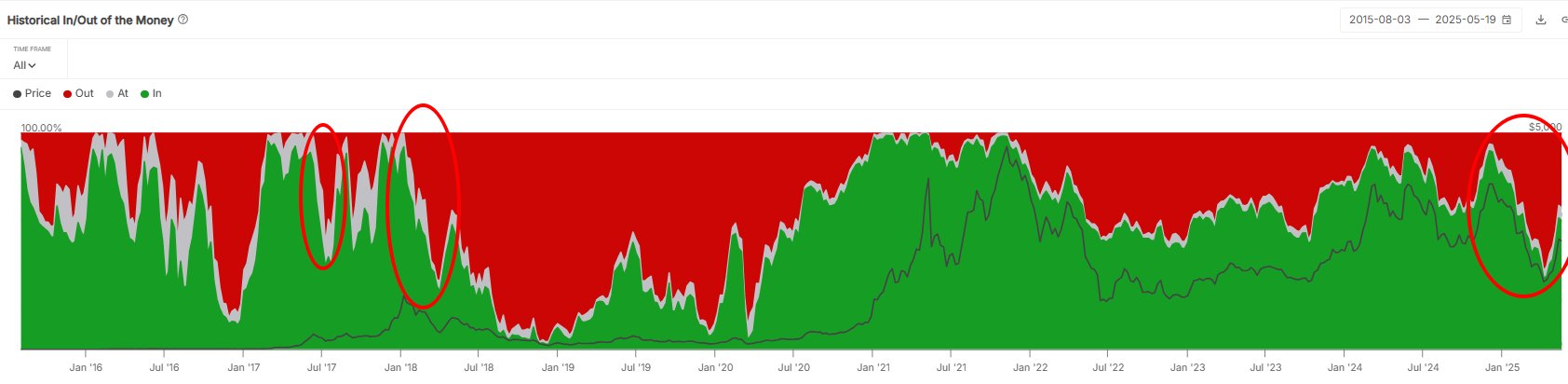

The chain chain indicator of correlation is “History/Exit of Currency”, which tells us which part of the ETH user base is profitable (“money”), loss (“cargo”), and even damaged (“in money”).

This metric is browsing the chain history of each address on the network to see the average price of coins it obtains. If this average cost basis is lower than the spot price of any wallet, then that particular user is considered a currency. Similarly, in the opposite case, the address is considered unpopular when the two prices are equal.

Now, here is a chart showing the trends in the historical trends of Ethereum over the past decade:

Looks like the amount of green investors has gone up in recent days | Source: Sentora on X

As shown in the above chart, Ethereum investors fell sharply after the sell-off that began in December 2024. Prior to this reduction, the metric accounted for more than 90%, which means that the vast majority of users held unrealized gains. However, by April 2025, as this value dropped to only 32%, the investor situation has completely disappeared.

Now, it seems like there has been another change in the address of the cryptocurrency, as ETH PRISS has seen a sharp rally this time. Now, almost 60% of holders are back in the currency, and although not above the same level as at the end of last year, it is significantly higher than the lows.

In the chart, analytics firms highlighted the last time Ethereum saw such a drastic swing in profitability. “Assets have not seen volatility of this scale since the 2017 cycle,” Sontora noted.

In some other news, ETH has recovered two important chain layers after its recovery, as discussed in its latest weekly report by analytics firm GlassNode.

The price of the coin seems to have surpassed the True Market Mean | Source: Glassnode's The Week Onchain - Week 20, 2025

From the chart, it is obvious that Ethereum recouped its realized price early in the run. The realized price represents the average cost basis for all investors on the ETH network. Currently, the price of this level is $1,900, which means that at the current exchange rate, holders will make significant profits.

The cryptocurrency also now manages to surpass the real market average at $2,400, a model similar to realizing prices, except it aims to find more accurate market average acquisition levels by excluding the missing lower dormant supply.

Ethereum now has only one level left to recover: the active implementation price is $2,900, which is again the model iterated by implementation price.

ETH price

Ethereum has climbed to $2,660 after about 4% of last week’s rally.

The trend in the ETH price over the past five days | Source: ETHUSDT on TradingView

Dall-E, GlassNode.com, featured images from intotheblock.com, charts from TradingView.com

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.