“Nothing to stop this train” – The final game of tether, Bitcoin and USD

Saifedean Ammous, CEO of Saifedean.com and author of Bitcoin Standard, delivered a data-driven keynote at the Bitcoin 2025 conference, warning of the inevitable decline in the dollar and positioning Bitcoin as the only rational hedge. “The inevitable is a default, a depreciation or a default is inevitable.”

Using forecasts and flowcharts, bigwigs believe that the Bitcoin strategy of a coin will soon outpace its dollar reserves. “Then the tether will break the nail upwards,” he said. He predicted a scenario where 1 USDT could equal $1.02 and continue to revalue as the dollar weakens. “As the dollar fell, the tether became relatively stable.”

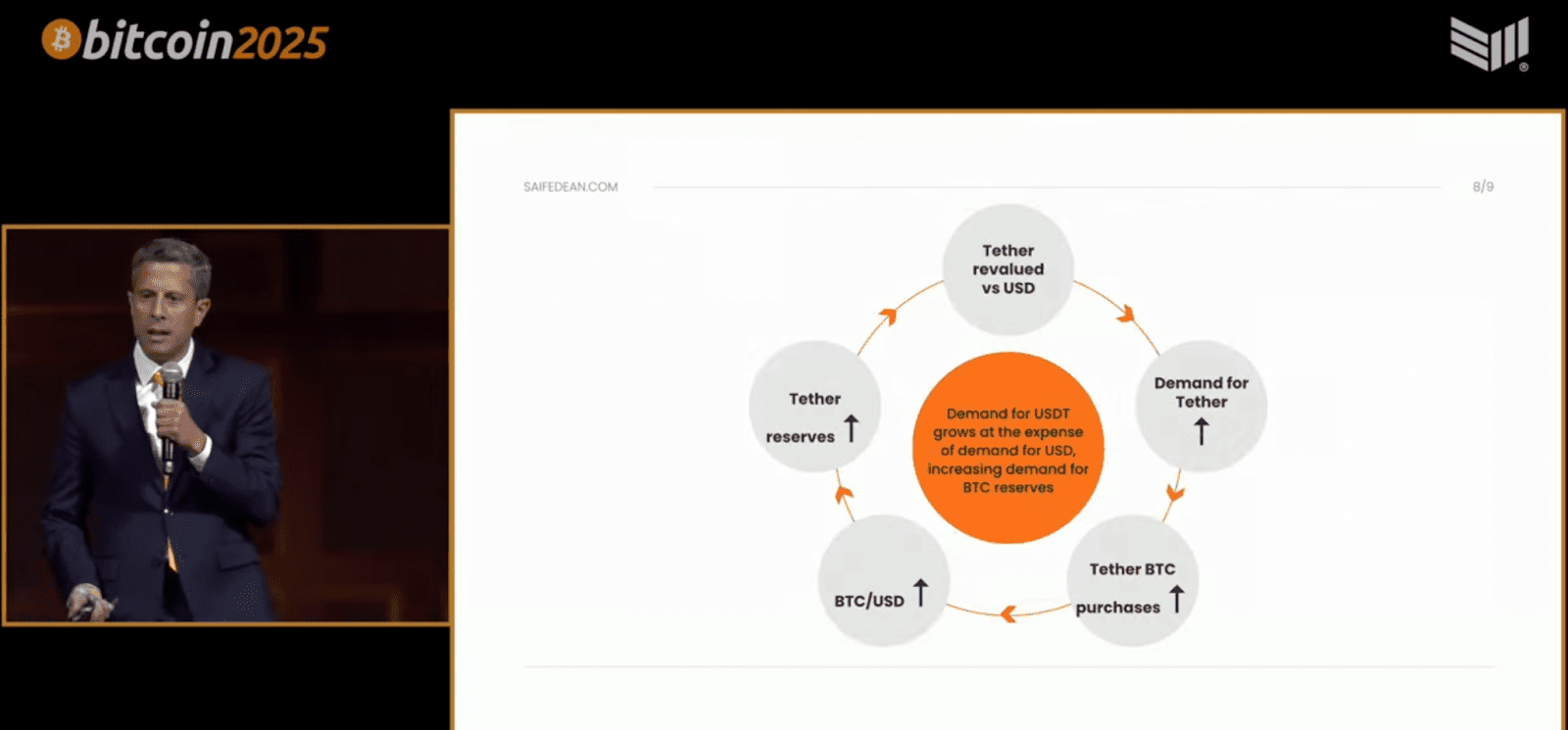

The speech highlights a self-enhanced cycle described by the atmosphere: As demand for USDT grows, Tether’s demand for BTC reserves also increases the price of Bitcoin, thereby increasing the price of Bitcoin, thus achieving a higher revaluation. “It’s a big impact on the market,” he said. “Buying Bitcoin is the smartest thing anyone can do.”

In the final publicity statement, the adults predicted the end of the US dollar era. “End of the day, the dollar reserve will be zero next to the BTC reserves,” he said. “USDT keeps revaluing until it can be exchanged in Bitcoin. SUSDT → BTCT.” He called the LeSystem a “transitional monetary system” and concluded: “Even the dollar is more bullish for BTC.”

For adults, the dollar is hanging on the spiral, while Bitcoin’s “digital upward technology” is still rising. “The rising thing will surpass the downward thing,” he said.