Pattern failure of Ethereum head and shoulders: Can the Bulls retract control?

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created by industry experts and carefully reviewed

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

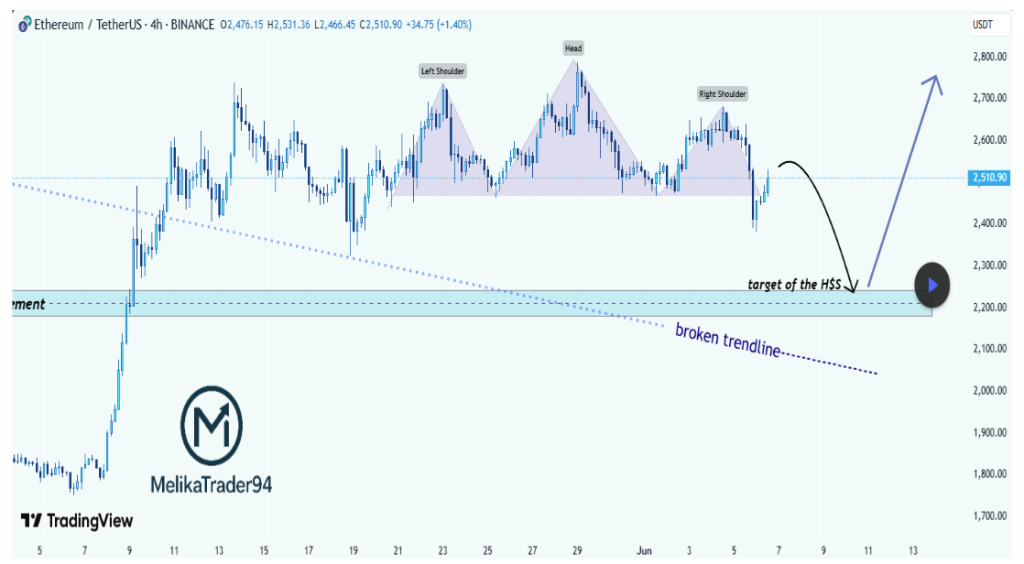

Ethereum’s recent price action on the 4-hour chart has led to the formation of classic head and shoulder patterns, opening up the possibility of deeper corrections. After a relatively stable period near the $2500 area, Ethereum Break under the neckline The level of support last week ended. This raises the question whether the Ethereum price has risen at the Ethereum price or whether the Bulls still have one Shooting with power recoverynNew week.

Related Readings

Head and shoulder mode confirmed after failures below $2,480

The head and shoulder patterns are now clearly visible in Ethereum’s 4-hour candlestick chart, one of the most well-known reversal formations in technical analysis. The chart and technical prospects first Share on TradingView Platform Crypto analyst Melikatrader94. The structure includes the left shoulder, a protruding head above the peak of $2,700 and the right shoulder above the $2,650. The neckline earned about $2,480 when Ethereum’s recent pullback to $2,380. This, in turn, shifts the short-term outlook to the bearish side.

After rest, Ethereum Try to take it back Lost ground, currently retesting the collar area. Retesting about $2,500 is significant because the failure to delay backwards above this level could validate the bearish setting and cause the Ethereum price to reverse downwards to the next support zone.

According to analyst Melikatrader94’s outlook, the target sales for the head and shoulders is between $2,200 and $2,250.

chart Image from TradingView: Melikatrader94

The Bull must recoup $2,650 to invalidate the bearish setting

A range of factors support the $2,200 area as a possible landing area. This level is consistent not only with measured movements in head and shoulder patterns, but also with order blocks over $2,000 at the Ethereum rally on May 9. This adds technical relevance of $2,200 to $2,250, which range acts as a support zone.

However, the situation is Not fully bearish. The way forward is obvious, but it is narrow for the Ethereum Bulls. The first step to invalidating the bearish setting is to decisively reclaim the neckline $2,500. In addition, return to the right shoulder height About $2,650 will make The head and shoulder pattern and another pattern will likely come into play.

Related Readings

A successful bullish recovery will not only invalidate the bearish pattern, but also regain the retest of $2,700 to $2,800, which corresponds to the recently formed pattern. Ethereum price before this recovery occurs Can be reversed quickly at any time.

At the time of writing, Ethereum trades at $2,510.

Featured images from Unsplash, charts for TradingView