Potential risks of SOLANA short-term indicator signal – reversal or pause?

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

Solana showed signs of strength as it pushed key resistance levels, which suggests that the bulls began to regain some control after weeks of weakness. The wider cryptocurrency market remains volatile, driven by ongoing macroeconomic uncertainty and intensified trade tensions between the United States and China. Despite these risks, investor sentiment seems to be improving slightly, fueling hope that Solana and other altcoins can enter the recovery rally.

Related Readings

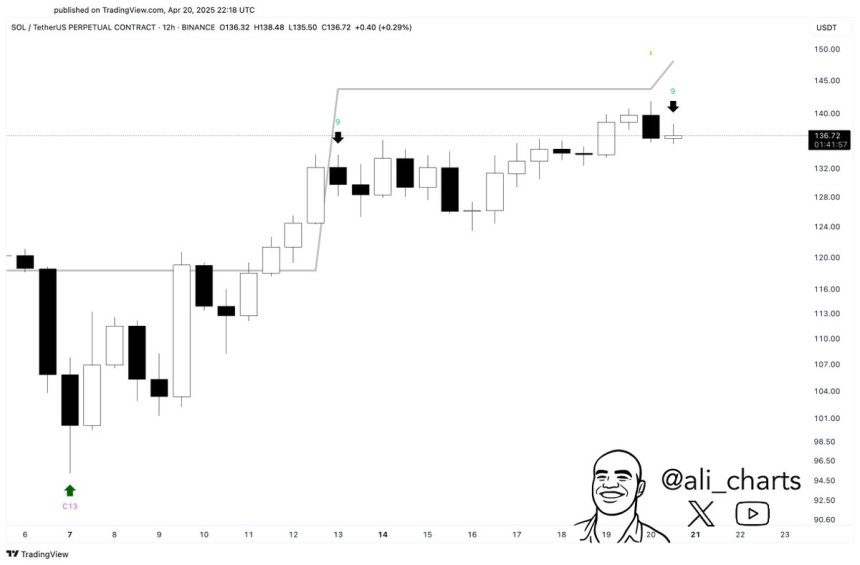

But caution still needs to be taken. Top analyst Ali Martinez shared a technical signal that has brought recent optimism (according to his analysis), Solana could experience a short-term pullback. Sell signals flashed on the 12-hour chart using the TD sequential indicator, which historically marked the stage of local tops and price exhaustion.

Although Solana’s recent breakthrough is encouraging, the existence of this bearish signal suggests that the rally may lose steam in the near term. Investors will keep an eye on to see if SOL can stay supportive at recycling levels or retreat under sales pressure. For now, the market is stuck between signs of early recovery and the risk of another leg falling.

Solana faces key resistance

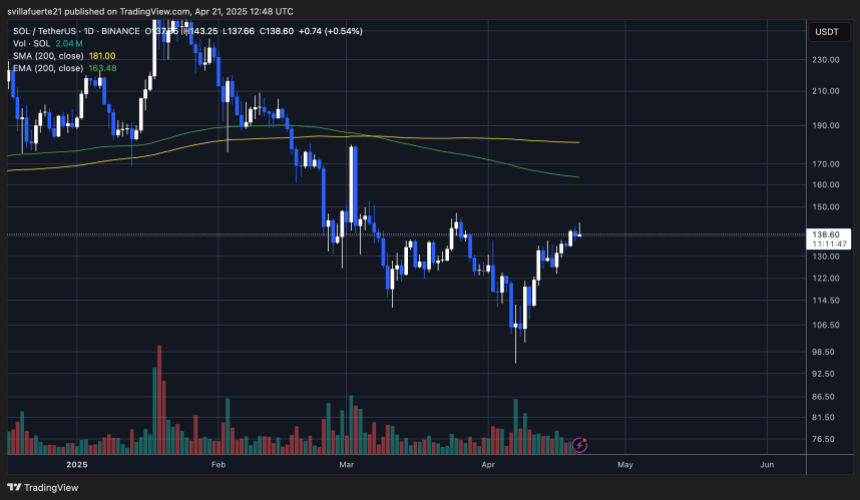

Solana has soared more than 48% since April 7, indicating that momentum has prolonged momentum after a long period of long sales pressure. With prices approaching the $150 level, the Bulls are now facing a critical test, a critical resistance zone that has been further progressing in the past.

Despite its recent recovery, Solana remains one of the biggest assets affected during the 2025 downtrend, with over 65% of its value since its peak in January. This emphasizes the importance of the current movement and the importance of maintaining a higher level to confirm the true reversal.

Nevertheless, be cautious. Martinez shared data on X on a 12-hour chart, which highlights the TD sequential sell signal, which is usually before the short-term trend is exhausted or reversed. The TD sequence is by determining a sequence of a series of price changes that may indicate excessive buying and selling conditions or overselling conditions. If the signal plays, Solana may continue to move forward in any continuous upward space.

Macroeconomic factors are still at work, and trade tensions between the United States and China are still shaping sentiment in global markets. But the hope of a potential agreement between the two countries and expanding global liquidity has made the Bull optimistic, especially within the altcoin sector.

Related Readings

Sol Price hovers in key areas: What’s next?

Solana (Sol) is currently trading at key levels, testing the critical $150 resistance zone after the recent low recovered sharply. The Bulls must retract and stay above this level to confirm the breakthrough and verify the start of the ongoing upward trend. Decisive moves over $150 could trigger further buying momentum, which could lead to higher targets that have never been seen since early March.

However, if SOL fails to exceed this barrier in the short term, it may still indicate strength during the merger period between $130 and $120. Holding this area would show that the Bulls are laying the foundation for ongoing price-up actions and absorbing sales pressure without a significant review. In a bullish market structure, this consolidation phase is often considered healthy, thereby rebuilding momentum before rebuilding the momentum.

Related Readings

The downside is that not holding a support level of $120 could put SOLs in deeper losses, and the $100 area is the next important area of demand. Breakthroughs below this level will invalidate the current bullish outlook and may reignite a wider downtrend. Currently, everyone’s eyes are centered around the reaction of the $150 mark.

Featured images from DALL-E, charts from TradingView