Since 2017

Data on the chain suggests that Ethereum whales have recently increased their accumulation, a sign that could be bullish at the price of assets.

Ethereum whales have been buying large

According to data from Chain Analytics Glass Festival, Ethereum whales have been involved in a very large accumulation over the past week.

“Whale” refers to an ETH investor who owns 1,000 to 10,000 tokens in cryptocurrency. On current switches, the range converts about $2.5 million on the lower end and $25 million on the upper side.

While the series does not cover the absolute top of the market, it still includes huge investors who may be considered a key part of the ecosystem. Therefore, given this role, the movements associated with these holders are worth monitoring.

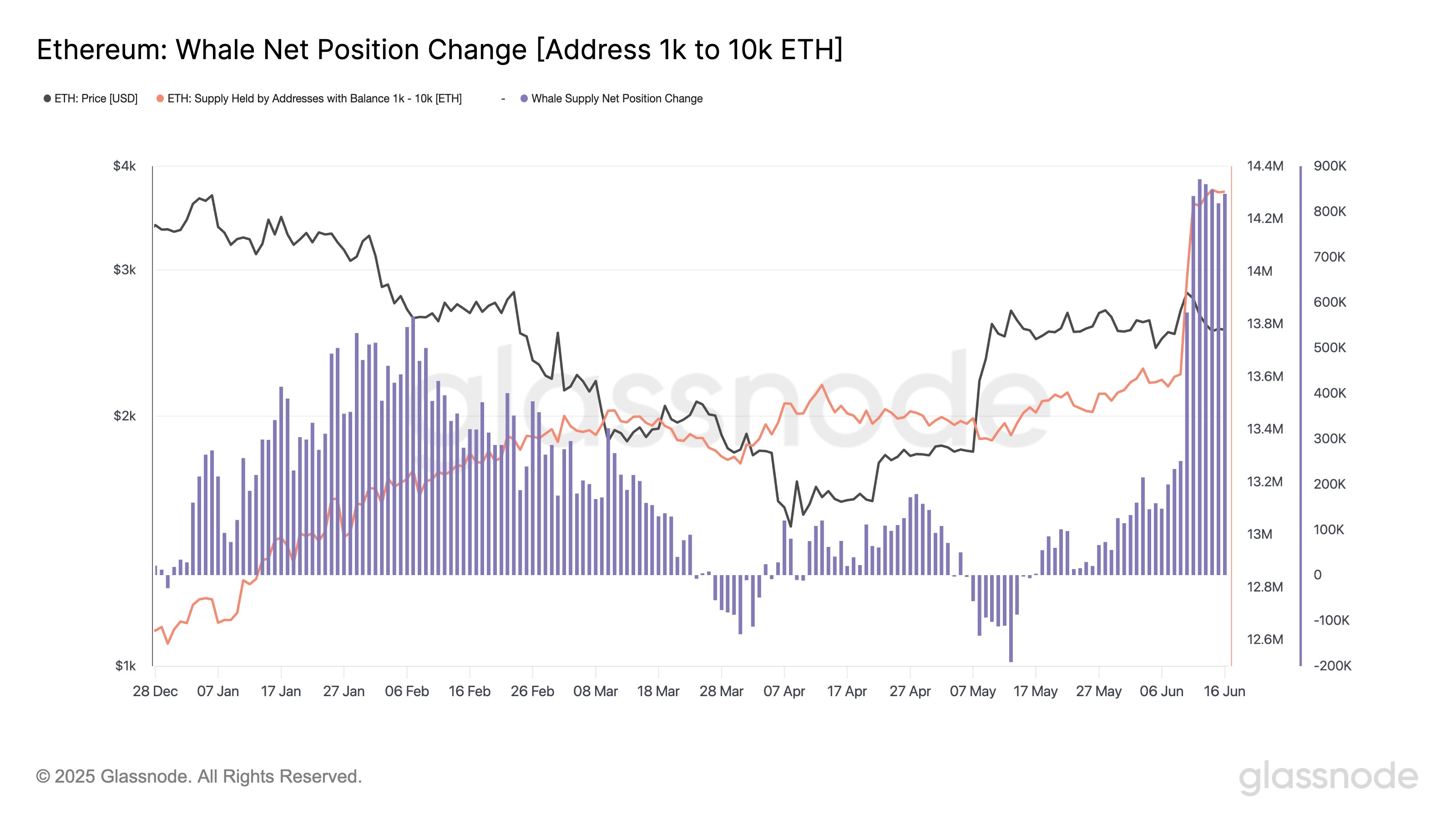

One way to observe whales’ behavior is through the total amount of Ethereum supply they hold. Below is a chart shared by the Glass Festival, which shows the trends of the indicator over the past few months.

The value of the metric appears to have seen a steep climb in recent days | Source: Glassnode on X

As can be seen in the picture, the supply of Ethereum whales has recently started, indicating that large investors have been accumulating cryptocurrencies. “In nearly a week, whales have accumulated more than 800,000 ETH every day, pushing 1k-10k wallet holdings to >14.3 million ETH,” the analyst firm noted.

From the chart, it is obvious that there was a particularly large spike on June 12. On this date, ETH whales added more than 871,000 ETH to their holdings, the highest daily inflow from their kind age to date.

The latest accumulation carnival not only attracts attention during the year, but also impressive in the historical context. “People have never seen this buying scale since 2017,” GlassNode said. Naturally, the extraordinary buying drive of these investors may indicate their confidence in the future of the coin.

Although this powerful accumulation activity has been found on the chain, the other side of the industry also sees demand: spot exchange funds (ETFs). Spot ETFs are investment vehicles that provide investors with a way to obtain Ethereum without directly owning assets.

Spot ETFs trade on traditional exchanges, so holders who are not familiar with cryptocurrency wallets and exchanges can find it easier to invest in coins through them.

Recently, there has been a high demand for US ETH live ETFs due to the NetFlow chart shared by GlassNode in the X-pillar display box.

The trend in the netflow of the US ETH spot ETFs since their inception | Source: Glassnode on X

“Last week, 195.32k ETH entered the U.S. ETH ETF, the third largest weekly net inflow on the record,” the analyst firm explained.

ETH price

Ethereum set its sights on $2,700 on Monday, but since then, the price seems to have been bearish as it is now trading at about $2,470.

Looks like the price of the coin has plunged over the last 24 hours | Source: ETHUSDT on TradingView

Dall-E, Featured Images of GlassNode.com, Charts of TradingView.com

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.