XRP sells rumors spin as expert question Ripple’s war box

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

Coinroutes CEO Dave Weisberger asked on a Scott Melker podcast Monday whether Ripple Labs could raise Circle for $1 billion without having to fund around $10 billion in XRP, and he ignited new anxiety in the XRP market. “Who will buy $10 billion worth of XRP, and they need to sell it from the Treasury Department? “Wesberg said, warning that a sudden surge in supply could overwhelm books and “find prices.”

Is it possible to imagine an XRP sell-off?

Within a few hours, Pro-XRP lawyer Fred Rispoli fired at X. “I love @Daveweisberger1, but at this point he worked very hard to McGlone,” he wrote, citing the reputation of Bloomberg strategist Mike McGlone to bearish. “Based solely on what Ripple shares offer on the secondary market, I don’t think Ripple even has to sell an XRP to buy Circle.” Rispoli agrees that Ripple can’t raise $10 billion in pure cash, but insists that the company can “easily afford a mix of cash and debt” and a large amount of equity relief.

Related Readings

When Weisberger replied that Circle’s board might need hard dollars unless it accepted Ripple stock or XRP “no hairstyles.” Rispoli dug in. “There is no way to get $10B cash, and the $10B price is too high,” he wrote, citing a private research valuation in late 2024, placing Ripple at the $15 Billion killiriv killiir selling for $15, selling $36 billion. If Circle’s price drops to $700-900 million, Ripple could end with “$100 million in cash on hand, a lot of stock exchanges and debt”, especially “now all GCC funds are now hanging out in the crypto world.” Rispoli admits that this would be “touching range” but “workable, no meaningful sale of XRP.”

Weisberger acknowledged that mathematics — “It’s a reasonable analysis,” he wrote — warned so far that any price on the upper end of the Rispoli range “can be short-term pain for US XRP holders.”

Ripple’s bid repurchase in January 2024 was estimated at $11.3 billion, and disclosed more than $1 billion in cash and about $25 billion in digital assets (mainly XRP). The company still controls about 52 billion XRP (about 40% of the supply), although 36 billion are placed in a timed hosted version, limiting instant access. At $2.20 today, the spendable portion is worth less than $35 billion, but even a small portion will be moved away soon and will collide with the thinner site depth, which is Weisberger Point Weisberger crashed into the home.

Related Readings

Ripple’s cash pile also narrowed a deal after buying Prime Broker Hidden Road for $1.25 billion in April, which was combined with cash, stock and RLUSD Stablecoins. The acquisition shows that the company prefers a hybrid structure, which reinforces Rispoli’s claim that the Treasury XRP does not have to flood the market.

Is the circle even for sale?

Debate may be academic. Circle, the issuer of USDC, repeatedly announced it would be “not for sale” when he went to the New York Stock Exchange to go public, and the list currently targets a $7.2 billion valuation. Ripple’s rumored approach was reported to be over $5 billion, well below the pressure case of Weisberger, in Rispoli’s “viable” band, but Circle rejected negotiations and updated the S-1 two weeks later, expanding the Float instead of seeking buyers.

Strategically, Ripple has already initiated the payment in January and is positioned by President Monica as a “supplement to XRP, not competitors.” The issuer absorbing the USDC will immediately rotate towards the size of a tether.

Even under Rispoli’s optimistic structure, Ripple still needs to liquidate hundreds of millions of working capital and shut down XRP. In current volumes, unloading only 500 million XRP (about $1.1 billion) will equal half a week of global turnover – unless executed as a private block, the price distorts the price.

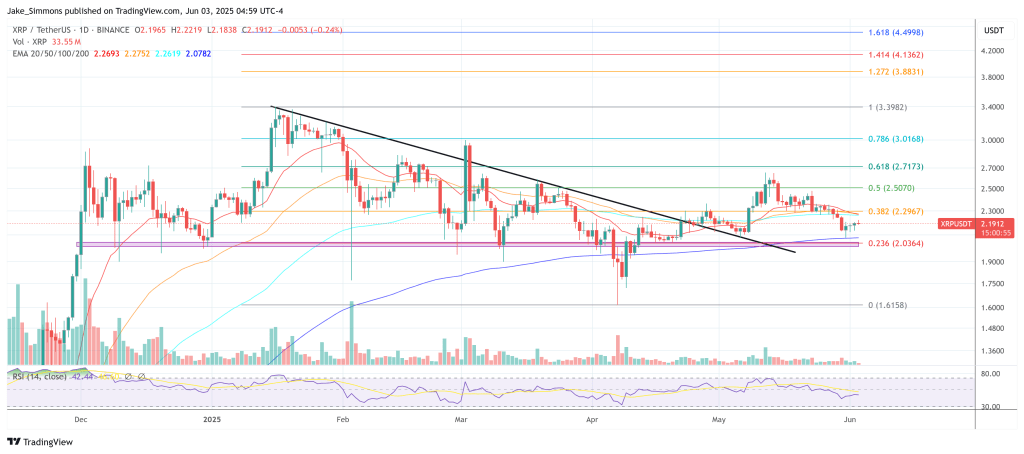

At press time, XRP was trading at $2.19.

Featured Images created with dall.e, Charts for TradingView.com