Strategy starts with 1,895 bitcoins from May – and more?

Michael Saylor’s strategy has announced a new Bitcoin purchase to start in May. According to past patterns, that’s how the rest of the month develops.

Strategy just added 1,895 BTC to its Bitcoin stack

Strategy Chairman and Co-founder Michael Saylor announced the company’s latest Bitcoin purchase in a new post about X. According to the SEC filing, between April 28 and May 4, the strategy acquired 1,895 BTC for $95,167 at a strategy with an average price of $95,167.

With the $180.3 million purchase, the company’s BTC holdings have risen to 555,450 BTC. In total, the company spent $38.08 billion to acquire the stack.

Strategy has been actively using Bitcoin purchases over the past few months, and community analyst Maartunn has noticed interesting patterns related to these purchases.

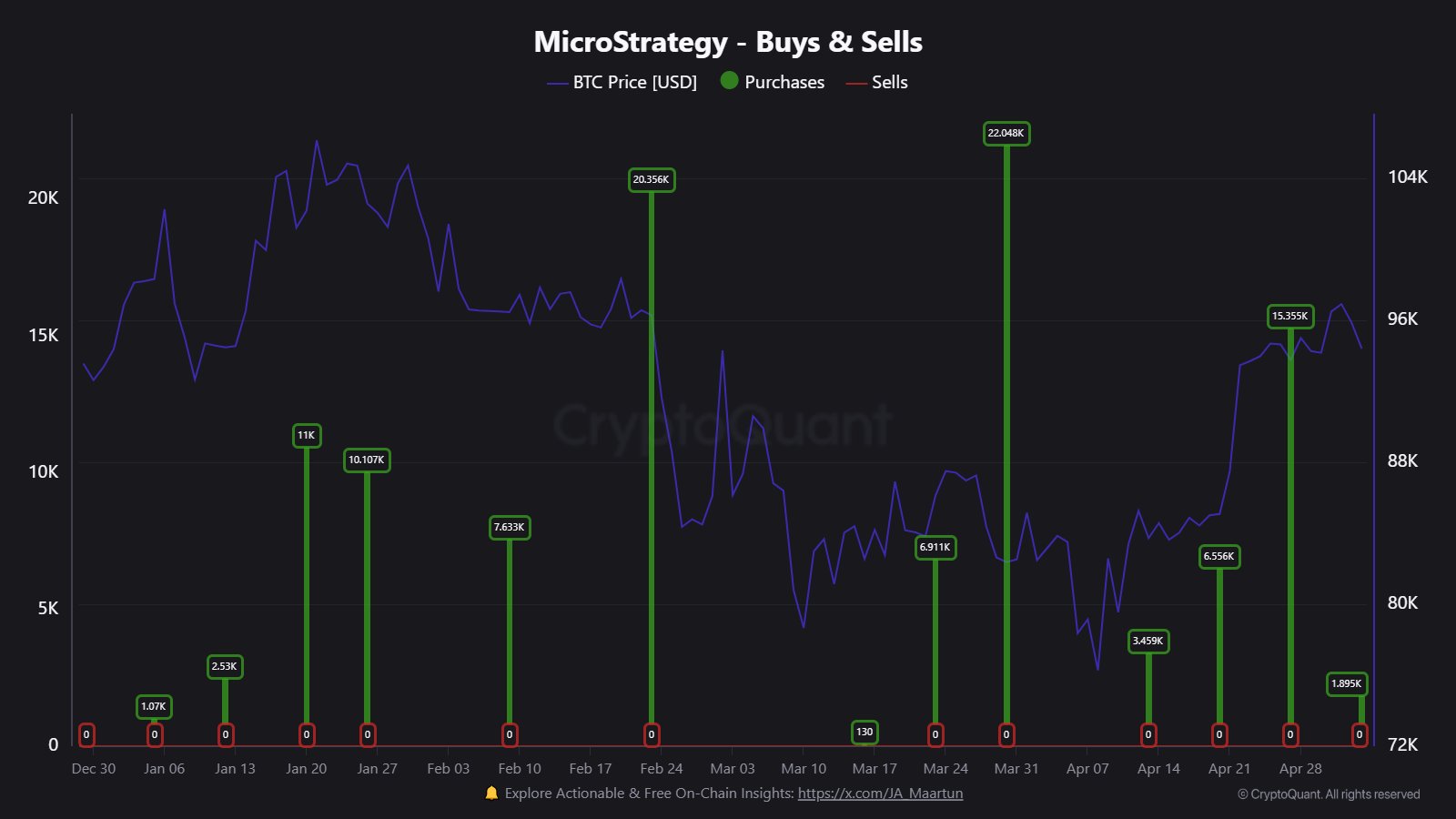

Below is a chart shared by analysts.

The timeline of the purchases made by the firm during the last few months | Source: @JA_Maartun on X

“The first micro-buy this month is always the smallest. As the month goes on, it accumulates.” The latest 1,895 BTC acquisition happens to be the first in May. Therefore, if any mode is available, it is possible that purchases (if any) this month will involve a large amount.

The company’s Bitcoin reserve currently has a cost base of about $68,550, so it’s profitable at the latest exchange rate of cryptocurrencies. So far, it seems that companies that have bet on Saylor are working hard.

In some other news, crypto writer Axel Adler JR shares what BTC currently looks like from a lens designed by analysts.

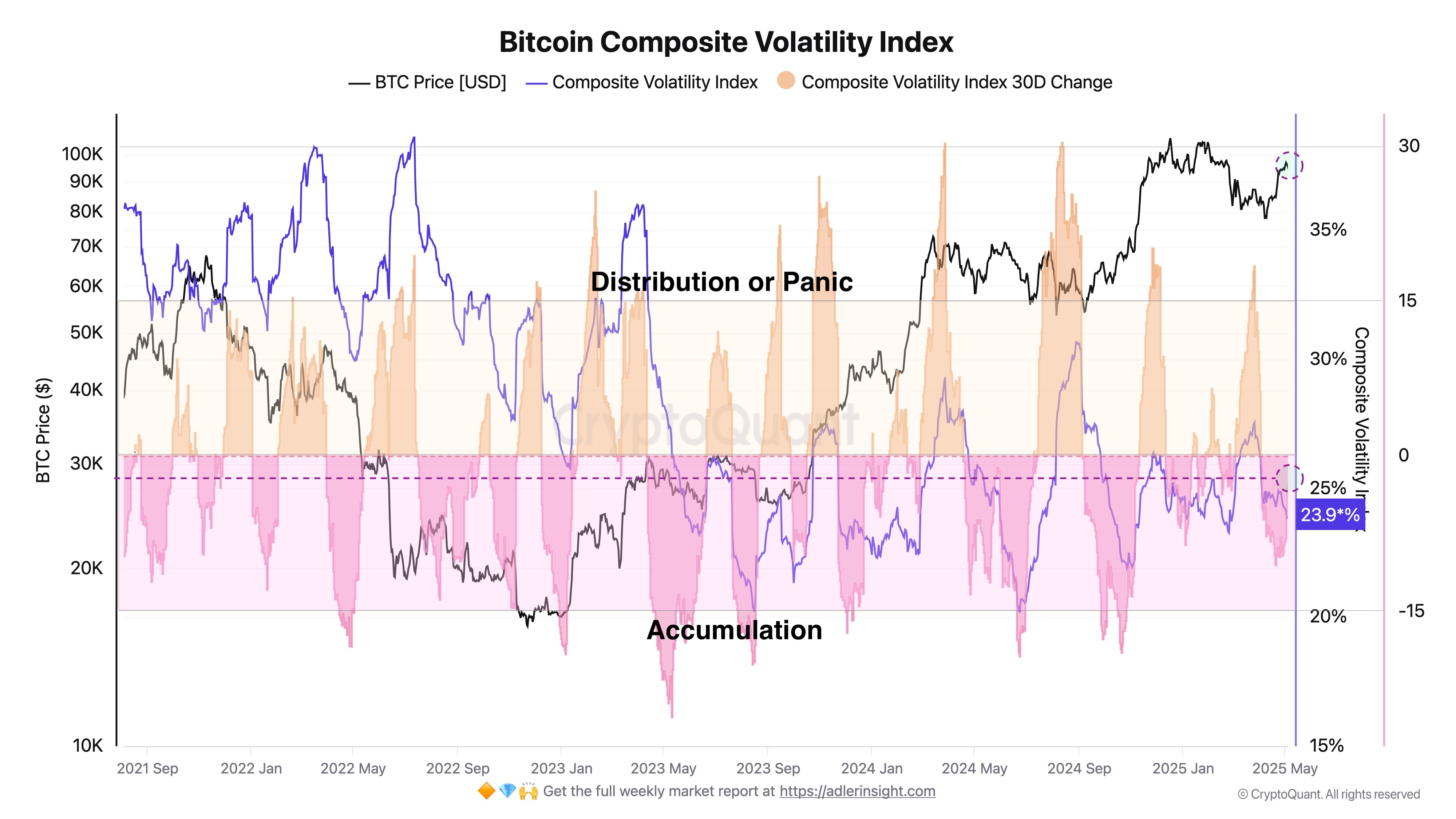

“An analysis of Bitcoin address activity, which is the basis of the compound volatility index and its 30-day changes, allows us to identify the macro phase of the market.”

Here is a chart of metrics shared by analysts that show the trends of day-to-day value and 30-day changes over the past few years:

Looks like the 30-day change in the metric has been negative in recent days | Source: @AxelAdlerJr on X

According to Adler JR, the 30-day change in the Bitcoin composition rate volatility index is less than 0%, indicating the cumulative phase of investors. Again, it exceeds 15% indicates a distribution or panic phase.

Judging from the above figure, it is obvious that the 30-day change of the indicator has recently assumed a negative value. Currently, it is located at -3.5%. So, at least from the perspective of this indicator, investors are accumulating.

BTC price

Bitcoin’s levels dropped below $94,000 earlier in the day, but the coin has found a rebound as its price is now back to $94,800.

The trend in the BTC price over the last five days | Source: BTCUSDT on TradingView

Featured images from dall-e, charts from cryptoquant.com, tradingview.com

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.