Test strength with critical support

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

esteartículo También Estádandousible enespañol.

Ethereum shows renewed power as it consolidates the mark above the $2,500 mark, which shows elasticity in the face of wider market volatility. After weeks of testing the $2700 region, ETH maintained a staggering distance of this key resistance, keeping the bullish momentum alive. Market sentiment has changed with Ethereum support, with analysts and investors increasingly pointing to the possibility of an upcoming playoffs.

Related Readings

Top analyst Big Cheds shared the technical failure and pointed out that ETH is now back to the key moving average after it exceeds the $2,700 range. This movement aligns with the bottom of the key resistance level to form a convergence area that can act as a springboard or rejection point in the coming days.

While Bitcoin is solidified at its all-time highest level, Ethereum seems to be attracting as traders look for opportunities outside of BTC. With ETH holding higher lows and establishing a stable base, a breakthrough in the range of over $2,700-2,800 can confirm a wider market spin to Altcoins. Currently, the Bulls must maintain control of over $2,500 to keep the structure intact and hope to move higher.

Ethereum is at a critical level as Bulls defend support

Ethereum is facing a critical test as it strives to recoup higher prices and confirm the ongoing uptrend. After multiple attempts to exceed the $2,700 resistance zone, the price has reached volatility, creating a volatile environment that reflects the wider uncertainty in the cryptocurrency market. Despite this, analysts remain optimistic about the outlook for Ethereum, especially as Altseason Chatter grows bigger.

Cheds recently shared a key insight: Ethereum has now returned to the 20-day moving average (DMA) after briefly soaring to the $2,700 range. This pushing the bottom surface that meets the 200-day simple moving average (SMA) creates a convergence area that can act as a launch pad for the next gathering, or a sand line that determines the short-term direction. Holding this DMA support is crucial. If the Bull defends this level, it may prompt the power of the update and trigger a breakthrough, which makes ETH return $3,000 and beyond.

With speculation and increasing technical pressure, Ethereum’s current structure remains bullish. It maintains high lows and continues to show signs of accumulation, which supports possible playoff arguments in the near future. If BTC stabilizes and clears resistance, the entire market may shift quickly.

Related Readings

Ethereum testing is supported at critical short-term levels

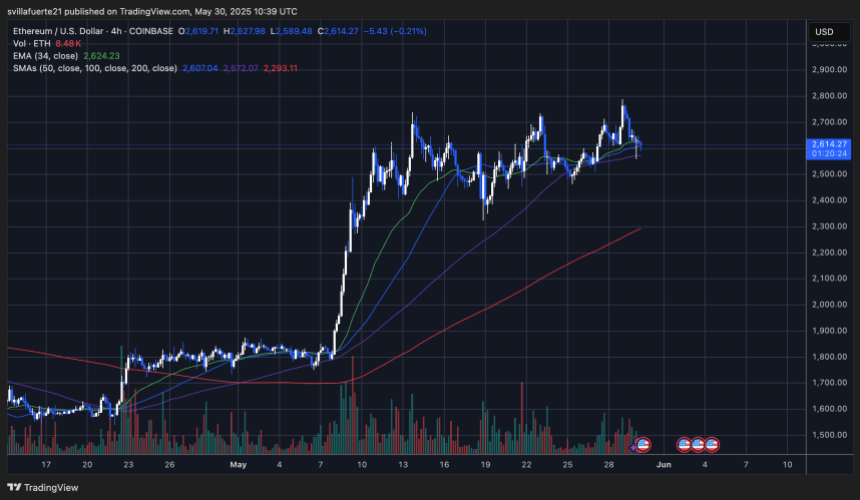

Ethereum summed up on the 4-hour chart as it hovers around $2,614, after a slight callback of $2,780 local top. The graph shows ETH retesting 34 cycles of EMA (currently close to $2,624) and finding short-term support at the confluence of 50 and 100 period SMAs. These moving averages are a dynamic support band that remained firm during previous answers in May.

The structure has remained bullish overall since its May 9 breakthrough, but the current price action is forming a tight wedge pattern, indicating an imminent breakthrough (both up and down). The number has been declining slightly, indicating that there may be a pause before the decisive move.

Related Readings

For Bulls, it is crucial to hold the above $2,580-$2,600 area. A clean bounce from here may try again to break the $2,700-$2,800 resistance area. On the other hand, if the sales pressure accelerates, a break below 100 SMA could bring ETH even further back to $2,500 or even $2,400.

Featured images from DALL-E, charts from TradingView