Bitcoin’s price surges over $95,000 – Analysts discuss real drivers

Bitcoin’s price has been impressive over the past few weeks, with psychological $90,000 above the $90,000 level in the past week. After surpassing $95,000 on Friday, April 25, the Prime Minister’s cryptocurrency appears to be approaching the weekend with the same momentum, if not greater.

Who is really behind the BTC rally?

In a new post on the X platform, Chain analyst IT Tech delved into the recent Bitcoin price rally, identifying the catalyst for that run, ranging from about $74,000 to $95,000. According to crypto experts, recent blockchain data shows that the capital rotation in the past month is clear.

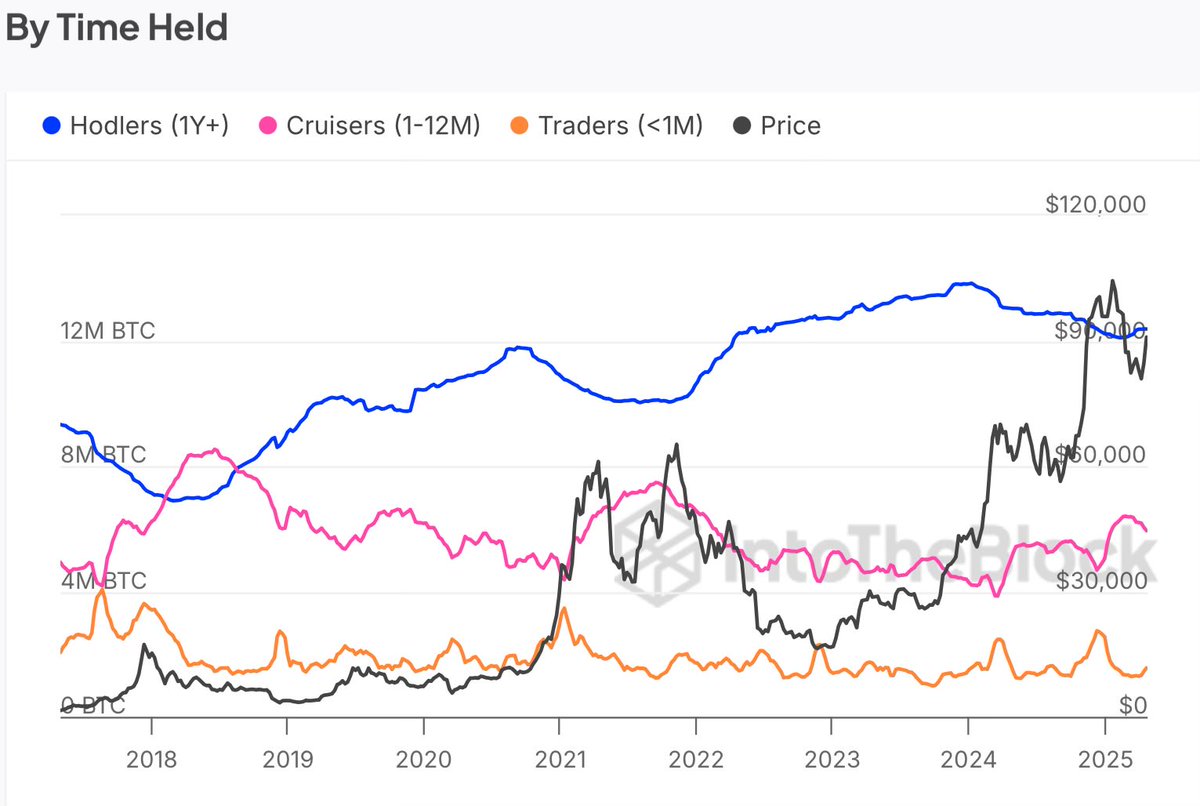

The analysis revolves around the activities of various Bitcoin investors (based on the time of holding coins). According to Intotheblock, it’s no surprise that most of the activity comes from traders (or short-term holders), whose equilibrium has increased by nearly 19% over the past 30 days.

IT Tech notes that these traders are in line with their reactive nature and are driven by FOMO (worrying to disappearance) have been actively buying BTC as its price drops to around $74,000. Meanwhile, short-term traders are not leaving gasoline at the price of bitcoin that exceeds $95,000.

Additionally, long-term holders in recent weeks seem to have stopped shaving their holdings, eliminating the “main overhead pressure” on Bitcoin prices. According to Intotheblock, the balance of BTC long-term holders has increased by at least 0.3% over the past 30 days.

Source: @IT_Tech_PL on X

Finally, its technology highlights a queue of investors known as the “cruiser” with Bitcoin holdings ranging from 1 to 12 months. Considering that balances fell by 4.4% over the past month, chain analysts mentioned that these investors either included it in “Hodell” or made a profit.

IT Tech concluded that Bitcoin prices may enter a speculative bullish phase, characterized by short-term capital inflows and long-term stability. However, analysts warn of the dominance of short-term hands.

Given their responsiveness, periods of highly volatile have historically been associated with the advantages of short-term holders. This means that the Bitcoin market may have high volatility in the future. In any case, IT technology believes that Bitcoin prices have not reached the local top level.

The price of Bitcoin is clear at a glance

As of this writing, Bitcoin is worth about $95,210, reflecting a 2% increase in the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured images from Istock, charts for TradingView

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.