Where can Bitcoin reach its peak in this cycle?

As Bitcoin looks as bullish as ever, the inevitable question is how high will BTC actually be in this market cycle? Here we will explore a wide range of chain evaluation models and cycle timing timing tools to identify reasonable target targets for Bitcoin peaks. While predictions are by no means a replacement for disciplinary data responses, this analysis provides us with a framework to better understand where we are and where we might be going.

Price forecasting tool

The journey begins with Bitcoin Magazine Pro’s free price forecasting tool, which compiles several historically accurate valuation models. While it is always more effective to respond to data rather than blindly predict prices, studying these indicators can still provide a strong context for market behavior. If the macro, derivative and chain data start to flash warnings, this is usually a good time whether or not a specific target target is reached. Nevertheless, it is helpful to explore these valuation tools and can guide strategic decisions when used with a wider range of market analysis.

In the key model, the top upper limit multiplies the average upper limit over time by 35 to project the peak valuation. It accurately predicted the top 2017, but missed the 2020-2021 cycle, estimated to be over $200,000, while Bitcoin reached its peak of $69,000. Now, its target of over $500,000 is feeling increasingly unrealistic. A further step is the top of the delta, subtracting the average upper limit from the implemented caps based on the cost basis of all cyclic BTC to produce a more grounded projection. This model proposes a $80k-$100k final cycle. However, the most accurate is the terminal price, adjusted coin days based on the destroyed supply, which is closely matched with each previous peak, including the 6.4K selling price in 2021. Currently expected to be around $221K, it could rise to $250,000 or more, and is still arguably the most reliable model for predicting Macro Bitcoin Bitcoin Bitcoin Tops. Of course, more information about all of these metrics and their calculation logic can be found under the chart on the website.

Peak prediction

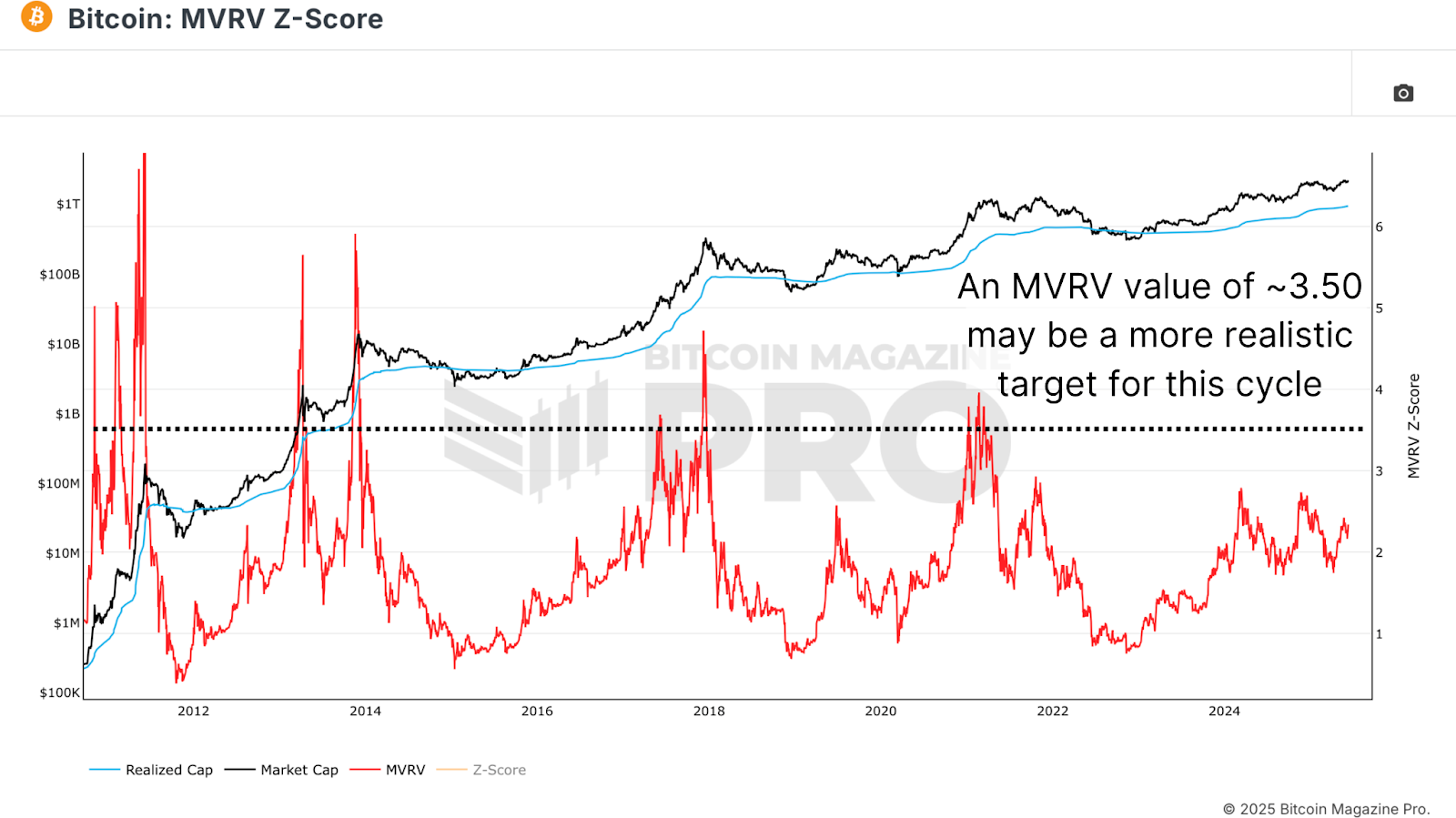

Another powerful indicator is the MVRV ratio, which compares market caps to the caps achieved. It provides a psychological window for investor emotions, usually reaching 4 values in the main cycle. The ratio is currently 2.34, indicating that there may still be a lot of room for upward. Historically, as MVRV approaches 3.5 to 4, long-term holders begin to achieve considerable growth, often emitting circular maturity. However, as the returns are reduced, we may not reach 4 this time. Instead, using a more conservative estimate of 3.5, we can start projecting more peak values.

Calculate the target

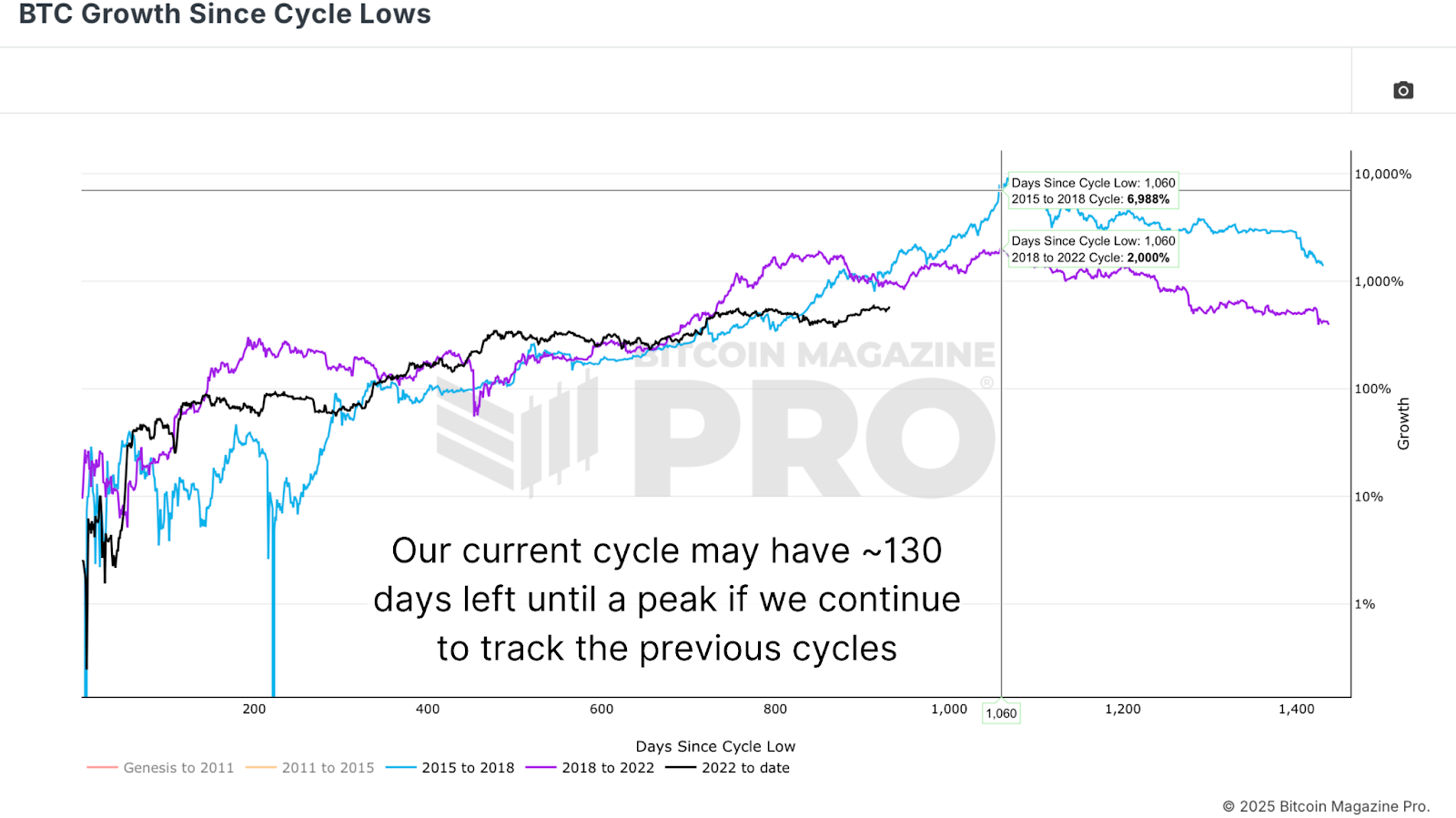

Time is as important as valuation. Analysis of BTC growth was from low cycles, which indicated that previous Bitcoin cycles reached a peak of almost 1,060 days from their respective lows. Currently, we have entered this cycle for about 930 days. If the pattern holds, we can estimate that the peak may arrive in about 130 days. FOMO-driven historical price increases usually occur later in the cycle, resulting in a rapid rise in price realization, average investor cost-based agents. For example, in the last 130 days of the 2017 cycle, the price achieved increased by 260%. In 2021, it increased by 130%. If we think growth is further halved due to lower returns, the current $47,000 realized price will bring us around $78,000 by October 18.

The estimated price is $78,000, with a conservative MVRV target of 3.5, and our Bitcoin price peaks at $273,000. While this may feel ambitious, historical parabolic hair dryer tops suggest that such a move could happen in weeks rather than months. While the peak expected to reach a peak is close to $150,000 to 200k, mathematical and on-chain evidence suggest that higher valuations are at least within the range of possibilities. It is also worth noting that these models are dynamically adjusted, and if late cycles start euphorically, the prediction can be accelerated further quickly.

in conclusion

Predicting the exact peak of Bitcoin is inherently uncertain, and there are too many variables. All we can do is position ourselves on the basis of historical precedents and on-chain data. Tools like MVRV ratios, end prices and Delta Top repeatedly demonstrate their value in anticipation of market fatigue. Although the $273,000 goal seems optimistic, it stems from past patterns, current network behavior and periodic timing logic. Ultimately, the best strategy is to react to the data, rather than a strict price level. Use these tools to inform your paper, but stay agile enough to make a profit as the wider ecosystem begins to signal to the top.

For more in-depth research, technical metrics, real-time market alerts, and access to the growing community of analysts, visit Bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Be sure to do your own research before making any investment decisions.