Why can Bitcoin price see another 70%-170% jump from here

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

Despite the crash before the weekend, the price of Bitcoin is still above $100,000. It has since bounced back from the $104,000 level, indicating that the Bulls stand on this major psychological level. Now, with the cryptocurrency market looking like a key point, the next step may be the question starting here. Is Bitcoin still able to rally, or is it the end of a rather short and sluggish bull market?

Bitcoin price still has a long way to go

When it comes to bullishness in Bitcoin prices, crypto analysts’ profits have always been the voice of voice. Even as the wider community expects cryptocurrencies to continue falling from here, he continues to demand higher prices. In fact, the crypto analyst believes that despite reaching several new all-time highs, the leading cryptocurrency can also see twice its price from here.

Related Readings

In an article on X, Profothotal explains the reasons behind this and why he thinks that the price of Bitcoin still has room for running. The first thing he pointed out was that a rare golden cross appeared on the Bitcoin price list. This happened three weeks ago, and then back then, analysts called up the chart formation, explaining that it meant that the bull run wasn’t over yet.

This is because every time Bitcoin has flashed the Golden Cross in the past, it is the beginning of another massive run. Just like now, first of all, the price drops by 10%, which is achieved when Bitcoin drops from $111,900 to $100,000. Now that the first part of the trend seems to have been achieved, it is expected that the others will work just as well.

On top of that, he explained that Bitcoin has also formed its diagonal resistance, which it now hopes to stand out from. A successful break will bring it back to over $108,000 as it prepares for the next kick.

Macrofactors supporting the paper

Chart technology not only shows this possible recovery, but also the upcoming Consumer Price Index (CPI) data to be released on Wednesday can also be involved. Profit Doctor explains that Wall Street already expects CPI revenue to be 2.5%, which is quite a bit.

Related Readings

Instead, he believes that CPI will be lowered, reducing it between 2.1% and 2.3%. Lower numbers will mean slowing inflation, making more risk-taking and pushing markets (such as stocks and cryptocurrencies) higher.

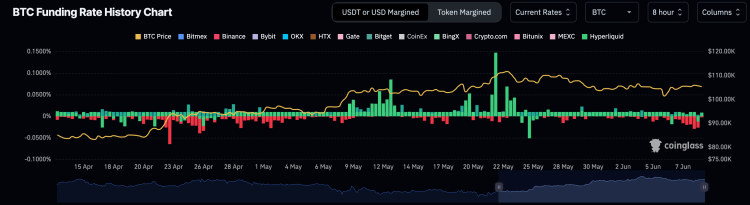

In addition, there is a problem with negative capital rates, which shows that there are more short objects on the market at present, expecting the price of tanks. Data from Coinglass show Bitcoin financing rates have fallen to one of the lowest levels this year, and analysts say it is a sign of a healthy market.

“Overall, I’m seeing a strong trend and the market will continue to grow at an initial target of 108-110k, and that’s not the last.” “In the coming months, the Golden Cross promised us a 70-170% return!”

Featured pictures from dall.e, charts from tradingview.com