Why is Bitcoin price continuing to rise despite the surge in stock yields? Analyst

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

Morbi Pretium Leo et nisl aliquam Mollis. quisque arcu lorem, super quisque nec, ullamcorper eu odio.

Bitcoin’s price has maintained a healthy momentum over the past few weeks, forging smaller swing highs and lows in its bull run revival. Interestingly, this early upward movement was corrected after the escalation of conflict between Israel and Iran.

In summary, although observations have been observed against historical perspectives, the overall positive prospect of cryptocurrencies in general remains. A chain analyst X on social media platform introduced this strange phenomenon in the BTC market and the possible reasons behind it.

Historical Relevance of Bitcoin and Macro Instruments

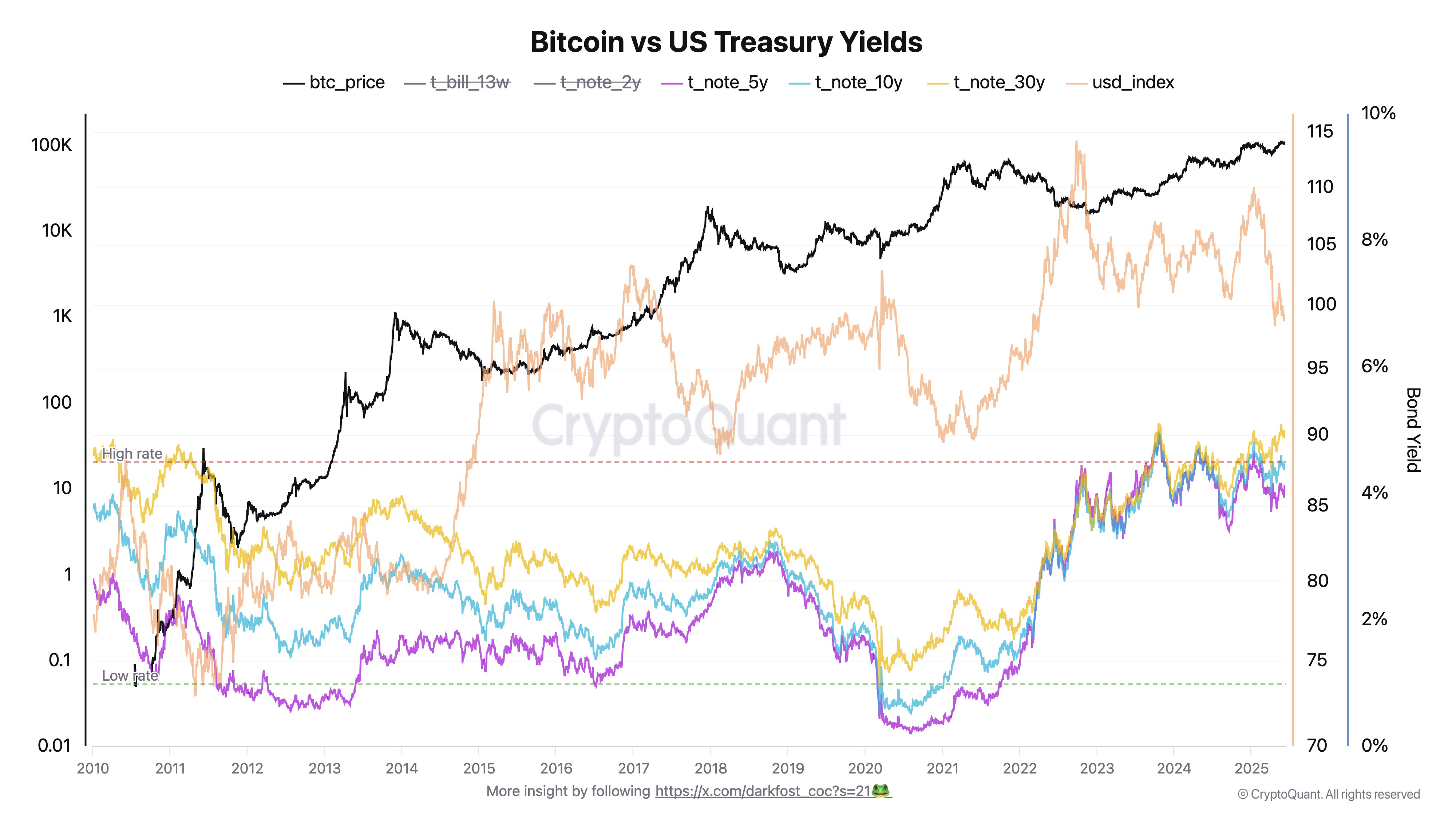

In the latest post on X Platform, a chain analyst with the pseudonym DarkFost has undermined traditional expectations of the Bitcoin market until recently relative to the broader macroeconomics. Crypto experts mention that investors consider key indicators when trying to decipher which institutional sentiment and the broader global liquidity state.

Related Readings

The main indicators for investors highlighted in this analysis include the US dollar index (DXY), which measures the value of the dollar vs. a basket of major foreign currencies and the yield on U.S. Treasury bonds, which basically represents investors’ income from U.S. government bonds.

According to DarkFost, the above diagram illustrates a well-known macro principle: when DXY and bond yields rise, capital tends to escape risky assets (one of which is Bitcoin). As a result, the Prime Minister’s cryptocurrency becomes vulnerable to corrections.

According to the chain analyst, this principle is backed by historical trends as the bear market of cryptocurrencies matches the strong rise in yields and DXY.

On the other hand, when DXY momentum loss and yield loss, investors’ appetite tends to turn to risk. Darkfost explained that the reason for this may be the reduction of expectations from the Federal Reserve, which has exacerbated bullish sentiment across the cryptocurrency market.

BTC destroys conventional macro logic

In the post on X, DarkFost continues to point out that the current BTC cycle is unusual. Online experts report that there is a decoupling between Bitcoin price and bond yields, which manifests itself as the abolition of the usual macro principles.

Analysts point out that despite surrender reaching its highest level in Bitcoin’s history, Bitcoin price continues to keep it rising. But this is, when DXY refuses, he will definitely notice.

Related Readings

Darkfost infers that this anomaly suggests that Bitcoin plays a new role in the macro landscape, thus increasing its perception as a store of value. Going further, this means that BTC may have less response to the macro forces believed to affect the cryptocurrency market as of now.

As of this writing, Bitcoin’s price is below $106,000, reflecting nearly 2% growth over the past 24 hours.

Featured images from Istock, charts for TradingView