Why MSTR beats BTC in 2025

As Bitcoin continues to show signs of sustained strength, it is worth mentioning that one of the highest leverage effects of BTC’s long-term papers: MicroStrategy (MSTR), recently known as “strategy.” In this article, we will evaluate the scale of the strategy accumulation, examine its risk/reward status, and explore whether the equity agent can be launched over time beyond Bitcoin itself. With the convergence of multiple indicators and capital rotations likely in progress, this could be a key turning point for investors.

Strategy Bitcoin Accumulation Soars to 550,000 BTC

It is clear from the analysis data of our finance companies that the pace of strategy of Bitcoin accumulation in recent months is understandable. Starting this year, the company now has about 386,700 BTC and now has over 550,000 BTC, which is a staggering growth, demonstrating a clear and intentional strategy for potential breakthrough activities.

Led by Michael Saylor, the acquisition was methodical, regularly purchased weekly, and now the total cost of billions of dollars is BTC. The company’s average acquisition cost is close to $68,500, which translates into current market profits close to $15 billion. With total spending now at around $37.9 billion, the strategy has broadly become the largest company holder of Bitcoin, positioning itself not only as a participant in this cycle, but also as a defined participant.

Potential winning rate of BTC/MSTR ratio signal MSTR

Rather than just comparing these two assets with the US dollar, a more illuminating analysis comes from BTC pricing in strategic stocks. This ratio provides insight into which of the two assets is relatively better or lagged.

Currently, the BTC/MSTR ratio is at a critical historical support level, matching the lows set at the bottom of the bear market in 2018-2019. If this level breaks, it may indicate that the strategy is on the verge of a period of relative strength with the persistent relative strength of the BTC itself. Instead, this supportive rebound suggests that Bitcoin can recover its advantages and provide better short- to medium-term risks/rewards.

This chart alone is worth keeping a close eye on in the coming weeks. If the ratio confirms a failure, we may see a large capital rotation to the strategy, especially from institutional allocators seeking access to high βBTC agents with public market access.

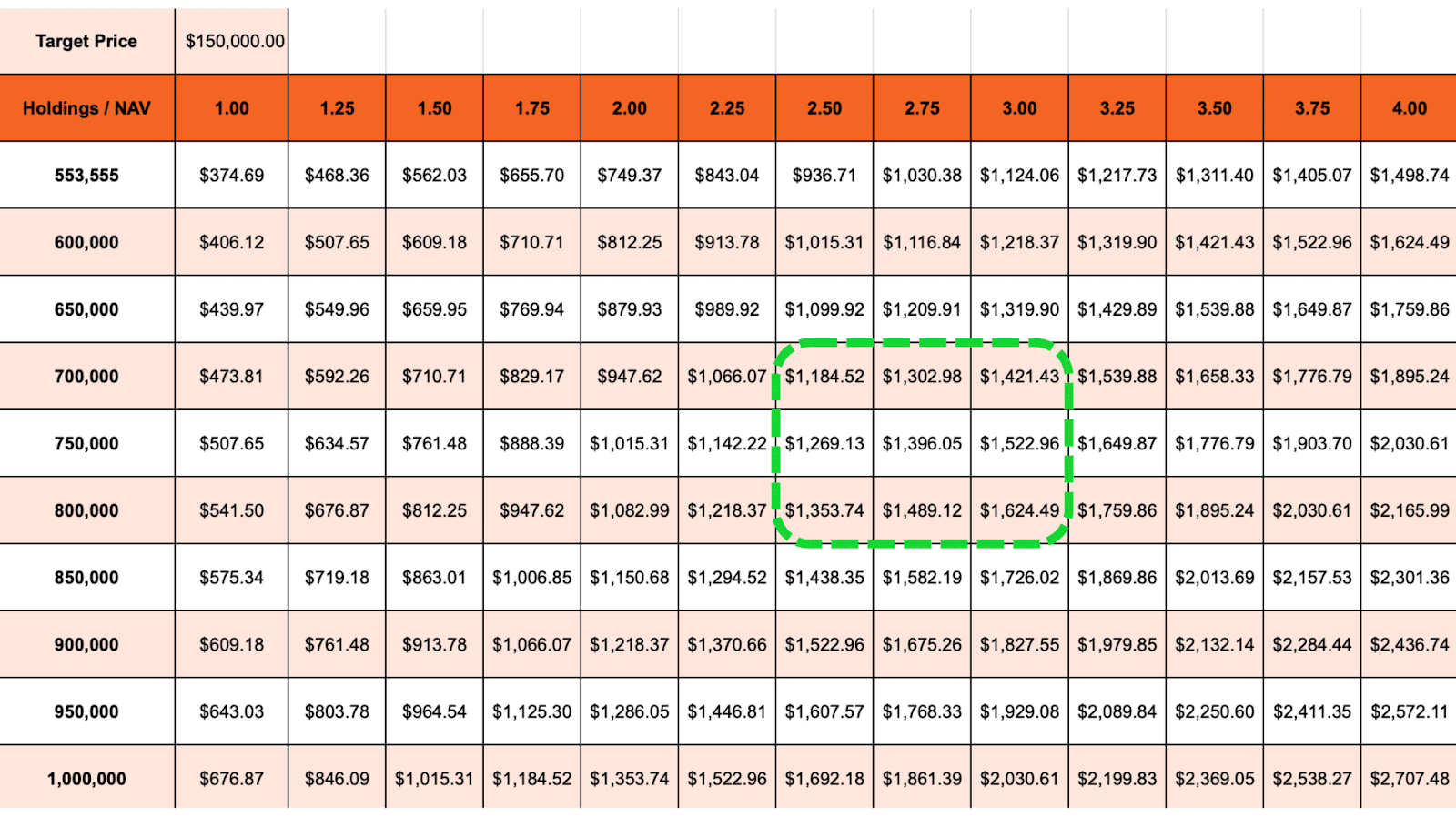

MSTR PLASS Target: $1,200-$1,600 with Bitcoin’s 2025 Rally

Although it is impossible to predict the exact result, we can infer from the current trajectory of the strategy and apply a reasonable Bitcoin cycle assumption. At the current acquisition rate, the strategy can strive to be between 700,000 and 800,000 BTC by the end of 2025. If Bitcoin rally reaches $150,000, this is a general peak in this cycle, and we apply a 2.5- to 3 times net asset premium (consistent with the historical precedent of reaching 3.4 times), this will result in an estimated share price between $1,200 and $1,600.

These figures point to very favorable asymmetric settings, especially when compared to Bitcoin itself. Of course, this forecast assumes persistent bullish conditions. But even in more conservative cases, mathematics supports the idea that strategies have meaningful upward advantages, albeit with greater volatility.

Strategy: The high beta agent that emerges in Bitcoin in 2025

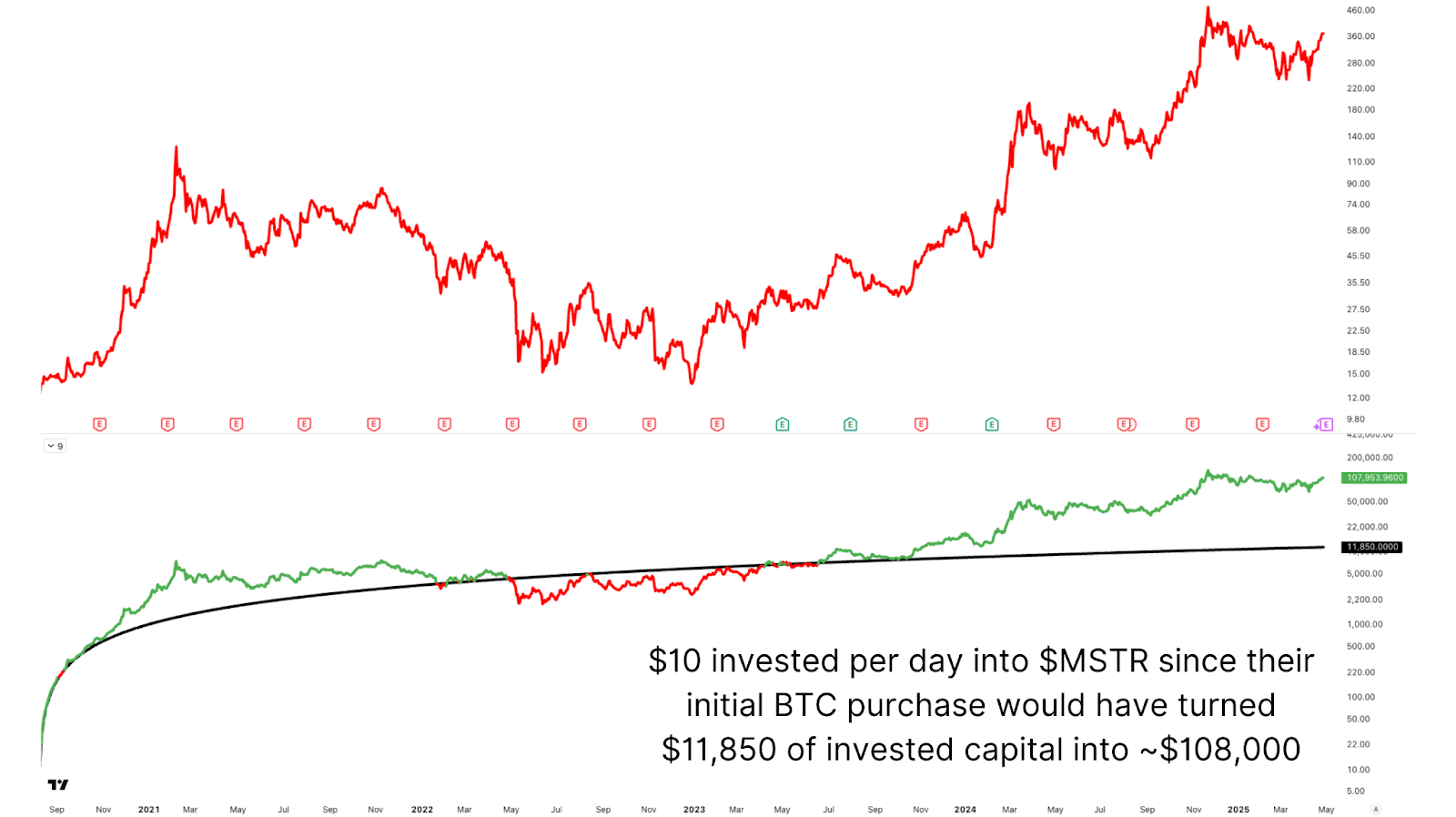

To further strengthen this situation, we can compare historical dollar cost average performance between BTC and strategy. Using the USD Cost Average Strategy Tool, you can see that if you invested $10 a day to Bitcoin over the past five years, your contribution totaled $18,260 and is now worth more than $61,000. This is an impressive result, showing nearly every other asset class, including gold, which has recently soared to new all-time highs.

Since the first purchase of BTC in August 2020, the $10/day strategy for strategy stocks will result in a $11,850 investment. Now, the position is worth about $108,000, which is significantly better than Bitcoin in the same window. This suggests that while BTC remains the basic paper, strategy provides more room for upside for investors willing to tolerate volatility.

It is important to realize that the strategy is actually a high beta instrument associated with Bitcoin. This correlation expands growth, but also amplifies losses. If Bitcoin is going to get into long-term answers, such as 50% to 60% correction, the stocks of the strategy may drop more. This is not only a hypothesis. In previous cycles, MSTR showed extreme fluctuations, both upside and disadvantage. Investors who see it as part of their allocation must be satisfied with the higher volatility and the possibility of deeper reductions during the broader BTC weakness.

Why MSTR can lead Bitcoin’s 2025 Rally as a top proxy

So, is it worth seeing strategy as part of a diversified crypto investment portfolio? The answer is yes, but there are warnings. Given its close wound relationship with Bitcoin, the strategy provides enhanced upward potential through leverage and has historically proven return profiles, BTC itself has surpassed BTC itself in recent years. But this is due to the greater trade-offs, especially in turbulent markets.

The current BTC/MSTR ratio is located at the technology hub. A collapse will show that the strategy is performing well beyond performance. However, the rebound could reaffirm Bitcoin as a near-term asset. Either way, both assets still have to be watched. If this cycle enters a new stage of strength, a large amount of institutional capital is expected to flow into BTC and its most outstanding proxy strategies at the same time. For those who target early, rotation can be fast, aggressive and beneficial.

For more in-depth research, technical metrics, real-time market alerts, and access to the growing community of analysts, visit Bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Be sure to do your own research before making any investment decisions.