With the influx of institutional cash

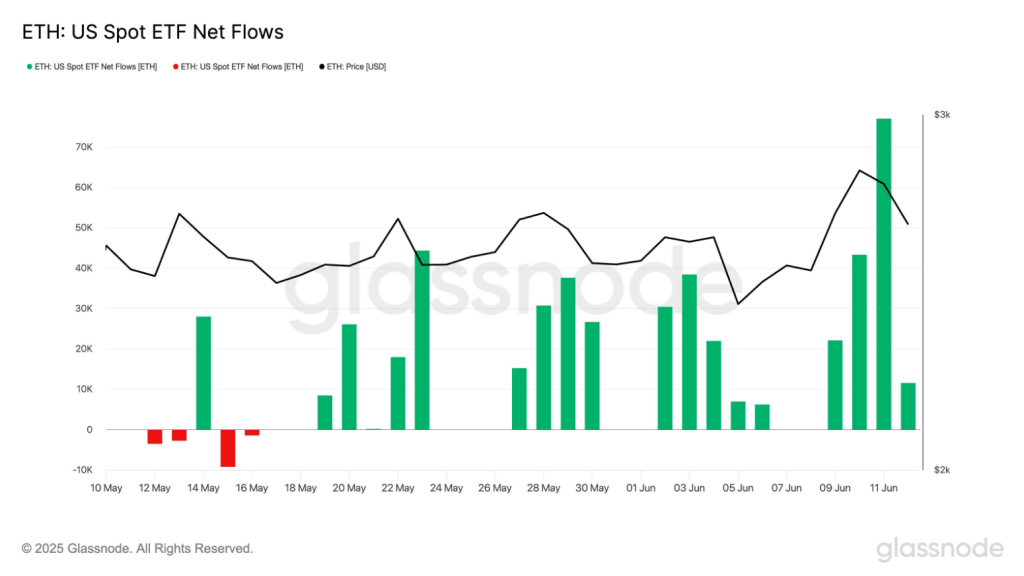

The U.S. live Ethereum ETF has attracted a surge in new capital this week, attracting 154,000 ETH over the past seven days, five times the recent weekly average. By comparison, Bitcoin Fund managed only 7,800 BTC during the same period.

This gap suggests a wider use of Ethereum, from defi to points rewards as big investors reconsider crypto allocations.

The rise of ETF inflow points to the shift betting

According to the report, June 11 is an outstanding day for Ethereum. The Spot ETF achieved a record 77,000 ETH in a meeting, marking the highest daily total of tokens so far this month.

Investors are watching prices close to $3,000 on the edge of the price. Beyond that level may stimulate more buying, especially as inflows remain strong.

$eth The spotted ETF is heating. This week alone, they saw 154K #eth Inflow – 5 times higher than the recent weekly average. For context: the largest single day $eth This month’s inflow is 77k #eth June 11. pic.twitter.com/8xlerbc6gx

– Glassnode (@glassnode) June 13, 2025

Ethereum stacking increases appeal

Another factor is accumulation. Holders can lock in ETH to help secure the network and win rewards. It is reported that certain ETFs may soon offer stocks that enable shares.

This setup can make Ethereum products more attractive than Bitcoin funds, which are not feasible. Buyers of production may find the extra boost difficult to resist.

Ethereum’s second layer solution has also attracted people’s attention. Programs such as optimism and arbitration are cutting fees and speeding up transactions. This improvement is to attract more developers and users to the fold.

As these aggregations surge, the real-world availability of the network continues to rise. For portfolio managers, the evolving ecosystem looks like a strong reason to support ETH.

Bitcoin is behind

Bitcoin still dominates the total ETF assets, but the recent inflows are flat. The 7,800 BTC added this week is almost no higher than the 7,900 BTC high on May 23 in the usual figures this week.

In early June, some funds even saw redemption, making the flow flow every day. This volatility may be driving some institutions to explore alternatives.

Image: SKapl/iStockphoto/Getty Images

Analysts point out that investors are looking for tokens with real-world use and upward potential. Ethereum’s role in decentralized finance, unsensible tokens and smart contracts gives it a versatile advantage.

Featured images from Unsplash, charts for TradingView

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.