This is to pay attention to the short-term Bitcoin level

Bitcoin has recently created a range boundary, with prices ranging from $83,000 to $86,000. Interestingly, popular crypto analyst Burak Kesmeci has identified important price levels for any short-term litigation.

Support is 82,800, resistance is 92,000 – but where is Bitcoin?

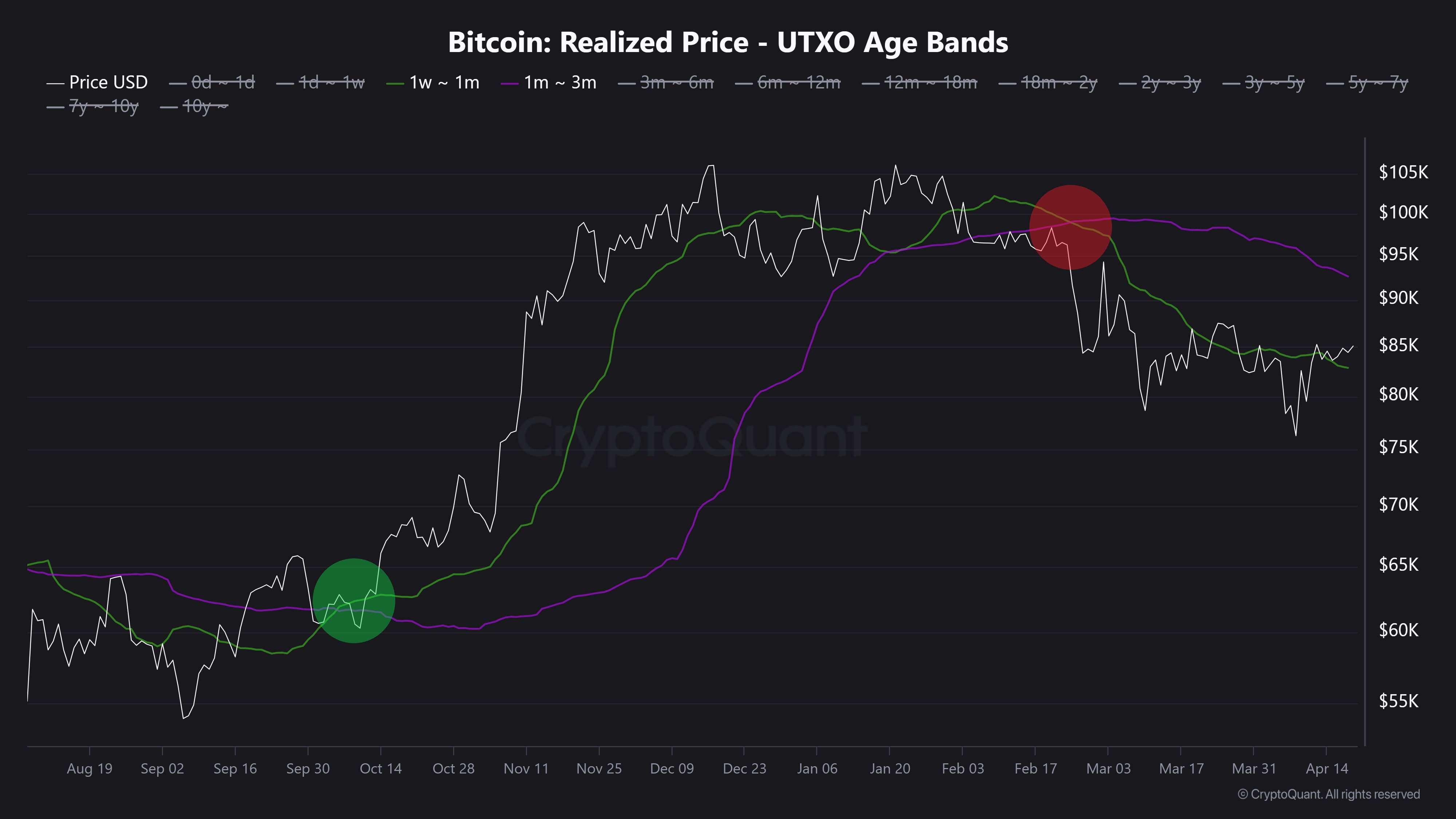

In a new post on X, Kesmeci shares an interesting chain analysis of the Bitcoin market. Analysts use short-term investor cost base to identify two key price levels that could be crucial for Bitcoin’s next big move.

First, Burak Kesmeci focuses on the average cost price of new traders over the past 1-4 weeks, which is probably the biggest change in price. These traders currently achieve a price of $82,800, forming recent support, indicating that many recent buyers are still profiting and may defend this level as a psychological level.

Meanwhile, Kesmeci also highlighted the $92,000 price level, which marks the average cost basis for BTC holders over 1-3 months. This price point has become an important resistance zone because investors are likely to exit the market once they go bankrupt. In addition, the price level of $92,000 is also marked with a convergence of various technical indicators.

The interaction between these two levels is important. Historically, short-term bullish trends in BTC tend to begin, when the cost base of recent investors (1-4 weeks) exceeded the cost base of 1-3 BTC holders. This signal of transition increases confidence and willingness to buy at a higher level, which often promotes wider gatherings.

However, this dynamic is still launched in the current market. As of now, Bitcoin is trading around 85,000, positioning it at a 1-4-week average of $82,800, but still below the 1-3-month resistance of $92,000. Furthermore, these two cost base levels have been declining over the past two months, reflecting the hesitation or lack of active purchases by new entrants.

It is worth noting that Kesmeci pointed out that BTC must soar above $92,000 to confirm the strong bullish momentum of the price reversal.

Bitcoin ETF uninstall 1,725 BTC

In other news, Ali Martinez reported that the Bitcoin ETF has withdrawn 1,725 bitcoins over the past week, worth $146.92 million. This development illustrates a high degree of negative sentiment among institutional investors, thereby increasing market uncertainty around the BTC market.

Meanwhile, after a 0.89% change in price over the past day, Bitcoin is trading at $85,249. Prime Minister’s cryptocurrency also reflects a loss of 0.58% on the weekly chart, with a monthly chart growing at 1.06%.

Featured images from Adobe Stock, charts from TradingView

Editing process For Bitcoin experts, focus on thorough research, accurate and impartial content. We adhere to strict procurement standards and each page is diligently evaluated by our top technical experts and experienced editorial team. This process ensures the integrity, relevance and value of our content to our readers.